The EUR/USD fell to its lowest level of the year last week at 1.1706, and tested 1.1805 on Friday before closing around the 1.1796 resistance. Despite the rebound, the currency pair is still under downward pressure as long as it is below the 1.2000 psychological resistance. The US dollar experienced sharp gains against the rest of the other major currencies following strong US jobs numbers, supporting expectations of higher US interest rates. The dollar's gains were halted after the US inflation figures which confirmed that the inflation explosion is temporary.

Despite the recent performance of the euro, there may be an important development in the global currency markets. According to researchers at HSBC, the euro is increasingly becoming a "risk-off" and less "procyclical" currency. This will have important implications for the expectations of the euro exchange rates. If HSBC is correct in its assessment, the continuation of the global recovery trade is likely to mean a decrease in the purchasing power of the euro against the pound.

The pricing of global financial markets indicates that a rate hike in the European Central Bank is not likely until at least 2024. Thus, risks to global economic growth and markets could benefit the EUR. But caution should be exercised against the significant deterioration that the virus may cause, as it is likely to include the emergence of a new COVID strain that is more transmissible than the current variants and appears resistant to vaccines.

Other risks include the Fed's policy error, perhaps as the Fed moves too quickly and aggressively when withdrawing financial support. Accordingly, HSBC expects that the EUR/USD in 2021 will end at 1.15 and the EUR/GBP will end at the end of the year at 0.86, giving a rate of the GBP/EUR of 1.1630.

A University of Michigan preliminary report released Friday said US consumer confidence fell to 70.2 in August 2021, from 81.2 the previous month and far below market expectations of 81.2. It was the lowest reading since December 2011.

On the other hand, data from the Labor Department showed that US import prices rose by 0.3 percent in July, after rising by a revised 1.1 percent in June. Economists had expected import prices to rise 0.6 percent in July compared to the 1 percent jump originally reported from the previous month. Meanwhile, the Labor Department said export prices rose 1.3 percent in July after a 1.2 percent jump the previous month. Export prices were expected to rise by 0.8 percent.

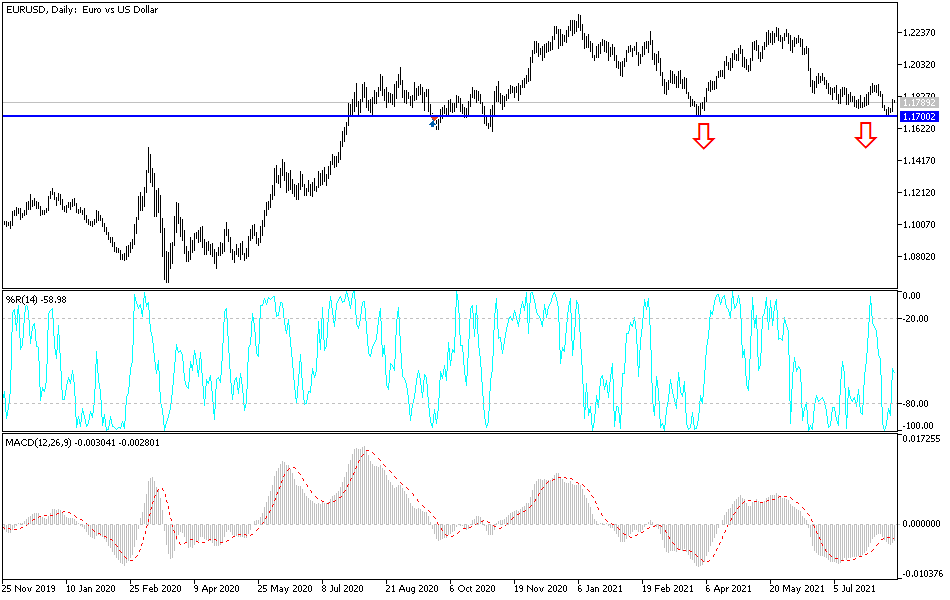

Technical analysis of the pair

The bullish correction of the EUR/USD will not be sustainable without breaching the 1.2000 psychological resistance. According to the performance on the daily chart, the general trend of the EUR/USD is still bearish. The closest support levels for the pair are currently 1.1755, 1.1680 and 1.1600, and I still prefer buying the currency pair from each descending level.

Today's economic calendar is devoid of important and influential European and American data, which means movement in a limited range for the currency pair. Risk sentiment will have the strongest impact on the pair.