The difference between success and failure in Forex trading is very likely to depend mostly upon which currency pairs you choose to trade each week and in which direction, and not on the exact trading methods you might use to determine trade entries and exits.

When starting the trading week, it is a good idea to look at the big picture of what is developing in the market as a whole and how such developments and affected by macro fundamentals and market sentiment.

There are still a few long-term strong valid trends in the market, so a few attractive opportunities remain, such as the U.S. stock market, which is continuing to trade close to record highs.

Big Picture 1st August 2021

Last week’s Forex market was relatively quiet, although more active than the previous week. This was due partly to the fact that we are well into the summer season in the northern hemisphere when global markets tend to get becalmed.

I wrote in my previous piece last week that the best trade was likely to be going long of the S&P 500 and NASDAQ 100 indices, plus going short of the EUR/USD currency pair following a daily (New York) close below 1.1750. Since then, the S&P 500 Index fell by 0.32%, while the NASDAQ 100 fell by 0.84%, giving an averaged loss of 0.58%.

Fundamental Analysis & Market Sentiment

The headline takeaways from last week were the potential economic impact of the resurgent coronavirus globally driven by the delta variant, and the U.S. Federal Reserve’s monthly policy release which gave a very small dovish tilt to its monetary policy. The Fed’s release pushed the US Dollar into bearish mode, and it spent most of the rest of the week selling off, albeit not especially strongly. US advance GDP data also came in considerably lower than expected, but this seemed to have little impact.

Last week also saw releases of Canadian GDP and inflation, and Australian inflation data. There were no big surprises there.

Next week will bring a similarly busy data schedule, notably US non-farm payrolls data and the Bank of England’s monthly policy release, as well as the RBA rate statement plus New Zealand employment data. The Forex market is therefore likely to show a similar level of activity next week.

Last week saw the global number of confirmed new coronavirus cases and deaths rise for the sixth consecutive week after falling for two months previously, suggesting that the spread of the more highly infectious Delta (Indian) variant is having a real impact on global numbers. Approximately 14.5% of the global population has received a full course of vaccination.

It seems to be becoming clear that due to the widespread Delta variant, which studies are beginning to show may be as easily transmissible as chickenpox, the only way to stop the natural spread of the disease by “herd immunity” would be for more than 95% of an entire population to be fully vaccinated. There are also signs that the effectiveness of vaccines wanes notably after approximately five months has elapsed from the last administration. If these indications become fully established, they will make even a local eradication of the coronavirus extremely difficult to achieve. Israel, one of the nations with the highest rate of inoculation, has just begun administering a third vaccination to over 60s.

The strongest growth in new confirmed coronavirus cases right now is happening in Algeria, Australia, Bahamas, Bangladesh, Cuba, Fiji, Finland, France, Georgia, Greece, Guatemala, Iceland, Iran, Iraq, Israel, Jamaica, Japan, Kenya, Laos, Lebanon, Malaysia, Morocco, Nepal, Nigeria, Norway, Philippines, Sri Lanka, the U.S., and Uzbekistan.

Technical Analysis

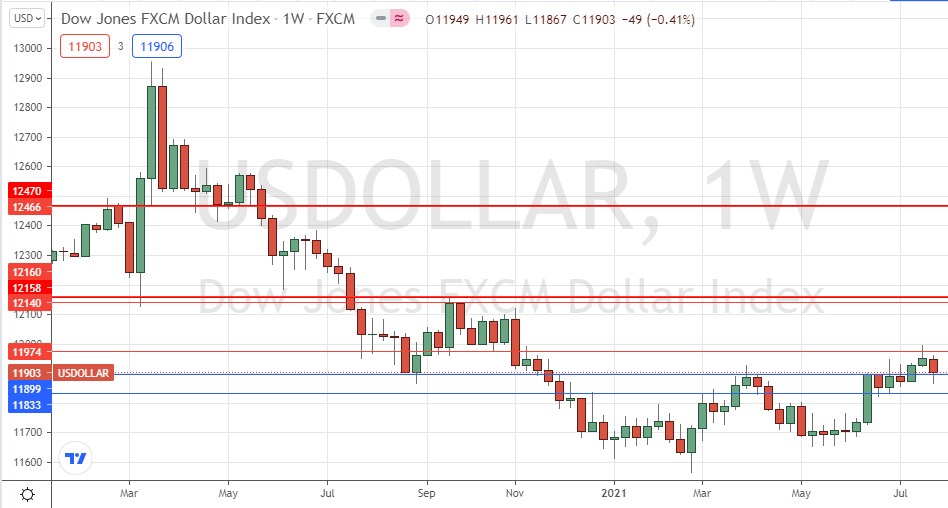

U.S. Dollar Index

The weekly price chart below shows the U.S. Dollar Index printed a weakly bearish engulfing candlestick last week. However, the fact that the price was held up so far by the support level at 11900 is a bullish sign, although the candle closed within the bottom half of its range and clearly rejected the obvious resistance level at 11974 which remains intact. The index is above its levels from both three and six months ago which shows a long-term bullish trend is still in force. Overall, next week’s price movement in the U.S. dollar looks slightly more likely to be upwards due to the prevailing trend. This suggests that trades long of the USD against other currencies are most likely to be appropriate over this coming week, especially if the index is trading above the nearest resistance level at 11974.

S&P 500 Index

The S&P 500 Index printed a small doji candlestick which made an all-time high price above 4425. Despite the downwards close over the week, the market still looks very bullish. I would look to get long again following a new daily close at an all-time high closing price. Since the coronavirus crash of 2020, this major U.S. equity index has more than doubled in value, which is an excellent return over barely sixteen months. The S&P 500 Index remains a conditional buy.

AUD/USD

The AUD/USD currency pair has been falling over several weeks, with the AUD showing the strongest long-term trend in the currency market as it weakens over several months. The Australian retail economy is now being hit by severe lockdowns due to the very low vaccination rate. This price trend has slowed down but seems to have some momentum, with last week printing another bearish candlestick that closed at a new multi-month low price. These are bearish signs, but it will probably be wise to wait for a daily (New York) close below 0.7328 before entering a new short trade in this currency pair.

Bottom Line

I see the best opportunity in the financial markets this week as being long of the S&P 500 index following a daily (New York) close above 4423 and short of the AUD/USD currency pair following a daily (New York) close below 0.7328.