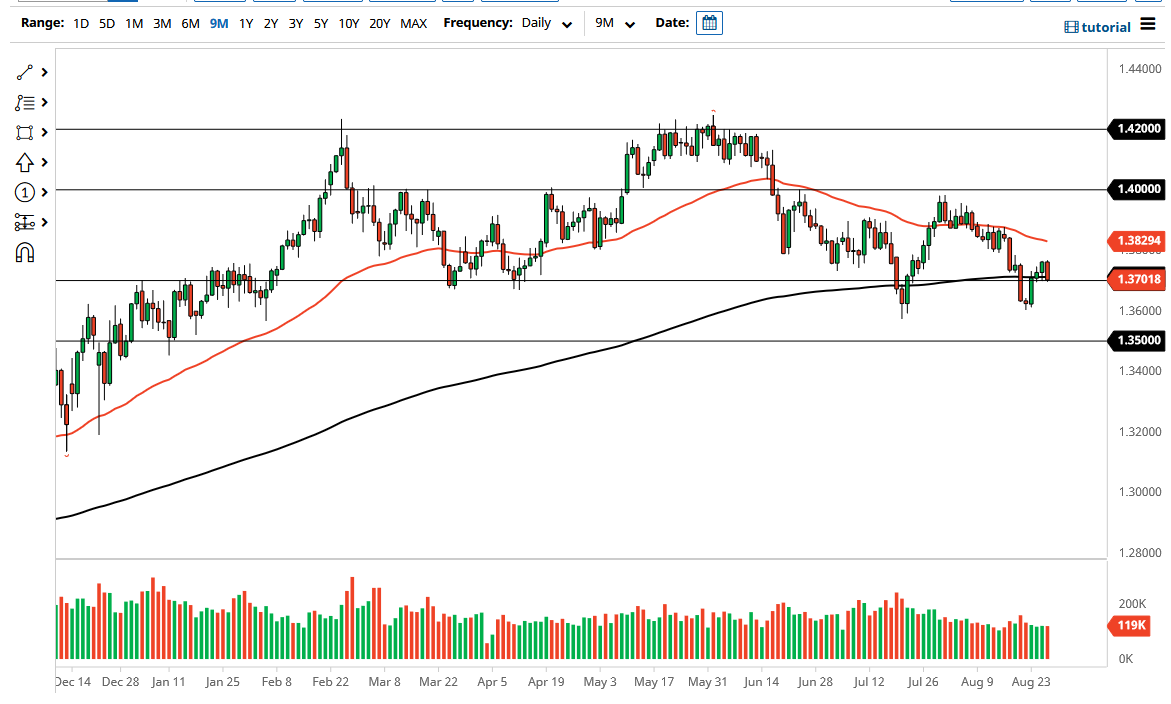

The British pound has fallen hard during the trading session on Thursday, to break down below the 200 day EMA to the downside again. As I write this, we are sitting at the 1.37 handle, an area that of course is a very important level in the past, and the fact that the 200 day EMA sitting in that general vicinity of course is a good sign of its importance as well. If we break down below the 1.37 level significantly, then we start to look at the 1.36 handle underneath which is the beginning of a bit of a “double bottom.”

If we do break down below that level, then it is likely that the market goes looking towards the 1.35 handle underneath, which is an area that would also offer a significant amount of support. The 1.35 handle being broken through then opens up a massive amount of selling, perhaps crashing the British pound another 500 points or so. That would obviously be based upon the strengthening of the US dollar and could of course be something to do with the Federal Reserve making a hawkish statement. If the Federal Reserve does in fact start typing, the US dollar will spike, and that could send a lot of pressure into this market.

On the other hand, if the Federal Reserve was going to be very dovish, then it is possible that we turn around a break above the highs of the last couple of days. In that scenario, the British pound goes looking towards the 50 day EMA which is sitting at the 1.3829 level as I record this and sloping lower. A move above that then allows the British pound to go looking towards the 1.40 level. That of course is a large, round, psychologically significant figure and an area that we have seen a lot of resistance over the last couple of months. Above there, then you have the massive resistance barrier at the 1.42 handle, but as things stand right now it does not look likely to be the case. It is very choppy, and it looks as if we are trying to form some type of “topping pattern”, and therefore as the technicals lineup, it certainly looks as if this pair is becoming much more negative.