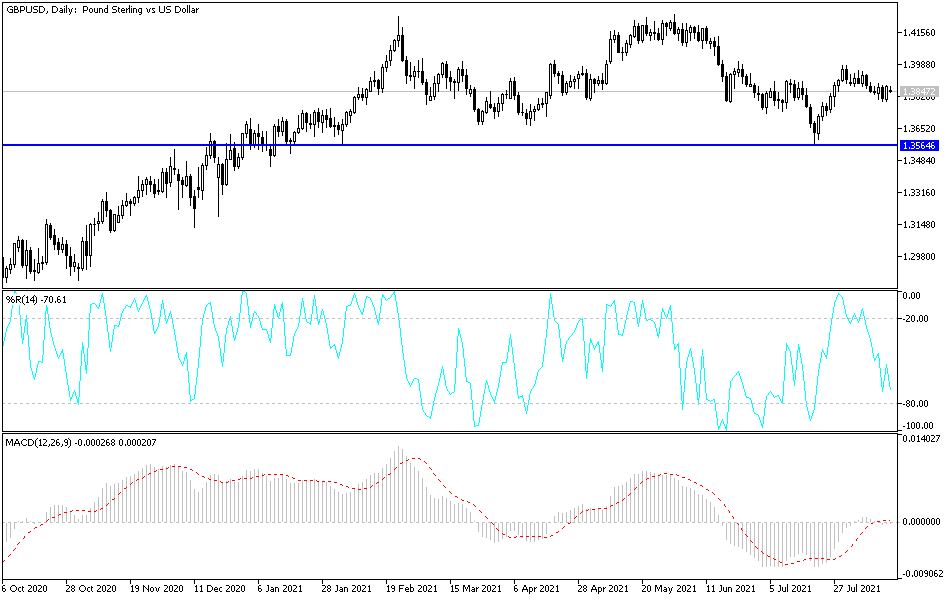

The British pound rallied a bit on Friday to reach towards the 50-day EMA. At this point, the market is going to continue to respect the 50-day EMA from what I can see, so the 50-day EMA being just above where we finished the session is not a huge surprise. The 50-day EMA has been a bit of a ceiling over the course of the week, as well as support from the previous trading week. The market is likely going to continue to see the indicators offer a certain amount of influence on where we go next.

This is a very bullish candlestick for Friday, but at this point I do not see any clarity as the only thing that I can make out of this chart is that we have nowhere to be. It is the quietest of the year as we are watching bigger traders focus more on holidays than anything else, so it is difficult to imagine we are suddenly going to make a big move in the middle of August. Nonetheless, if you are a short-term trader, you may look at this as a potential range bound trade, or perhaps pay attention to the fact that we are in a relatively well-defined descending channel.

If we do break higher, the most obvious resistance barrier is going to be the 1.40 handle, an area that has been resistive previously. That is an area that I also think will be very difficult to break, and if we do, it would be a very negative turn of events for the US dollar. The British pound has been a better performer against the greenback than some of the other major currencies, so if nothing else this might be a market that is going to be a bit resilient. We are certainly looking bullish as we close out the Friday session, but if we break down below the 1.38 handle, then it is likely that we would go looking towards the 1.37 level after that. To the upside, breaking above the 1.40 handle would be a massive breakout that could send this market looking towards the 1.42 handle. This is a very choppy market.