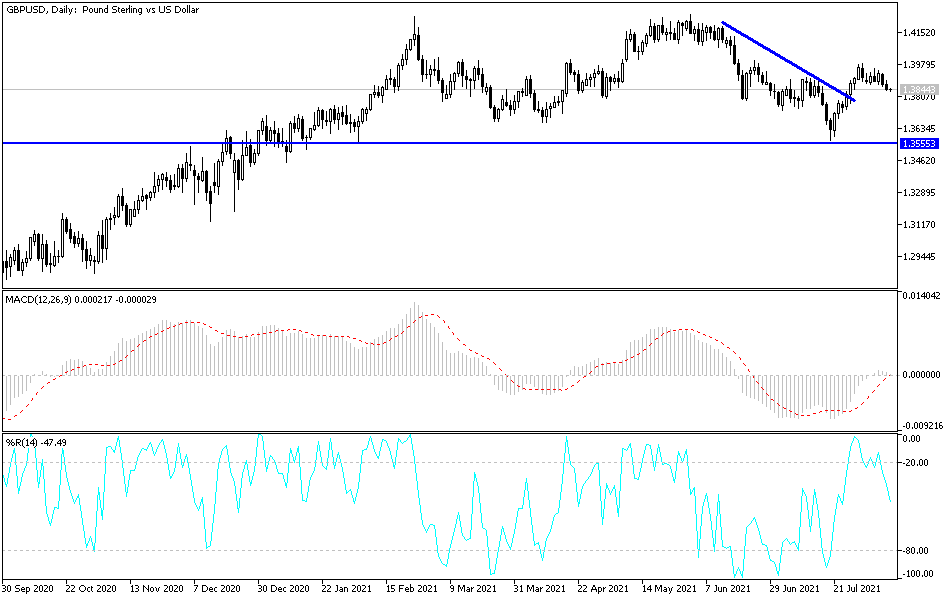

The British pound drifted just a little bit lower during the trading session on Monday as we continue to see the US dollar flex its muscles. As interest rates in America continue to climb, that will continue to drive demand for those very same US dollars. As we look at this chart, it is easy to see that the 50-day EMA has offered a bit of support, but the Monday candlestick certainly suggests that we are trying to break down through it. Because of this, I do think that it is more likely than not that we will go to the downside and go looking towards the 1.37 level underneath which is the next major support level.

On the other hand, you could make a bit of an argument for a bullish flag, and if that is going to be the case then we could go looking towards the 1.40 handle, and then the 1.42 handle based upon the areas both being significant resistances in the past. The 1.40 level has a certain amount of psychology attached to it as it is a large, round, psychologically significant figure, and the 1.42 level is an area that has been massive resistance multiple months over the longer term. I do not think we will get above that area anytime soon, but if we did it would more than likely than not end up being a “buy-and-hold” type of situation that people would be paying attention to.

To the downside, if we were to break down below the 200-day EMA and the 1.37 level, then it is possible that the market could go looking towards the 1.35 handle. The 1.35 handle underneath is massively supportive, and if we broke down below there it is likely that we could kick off a longer-term drop. That obviously would have something to do with the US dollar strengthening against almost everything, and the British pound would not be any different. Another thing that you will need to be paying attention to is the CPI figures later this week, as it could give us an idea as to whether or not inflation is picking up in America, and if the Federal Reserve will be pushed to tighten sooner than a lot of people had originally thought. Ultimately, I think the one thing you can count on is volatility.