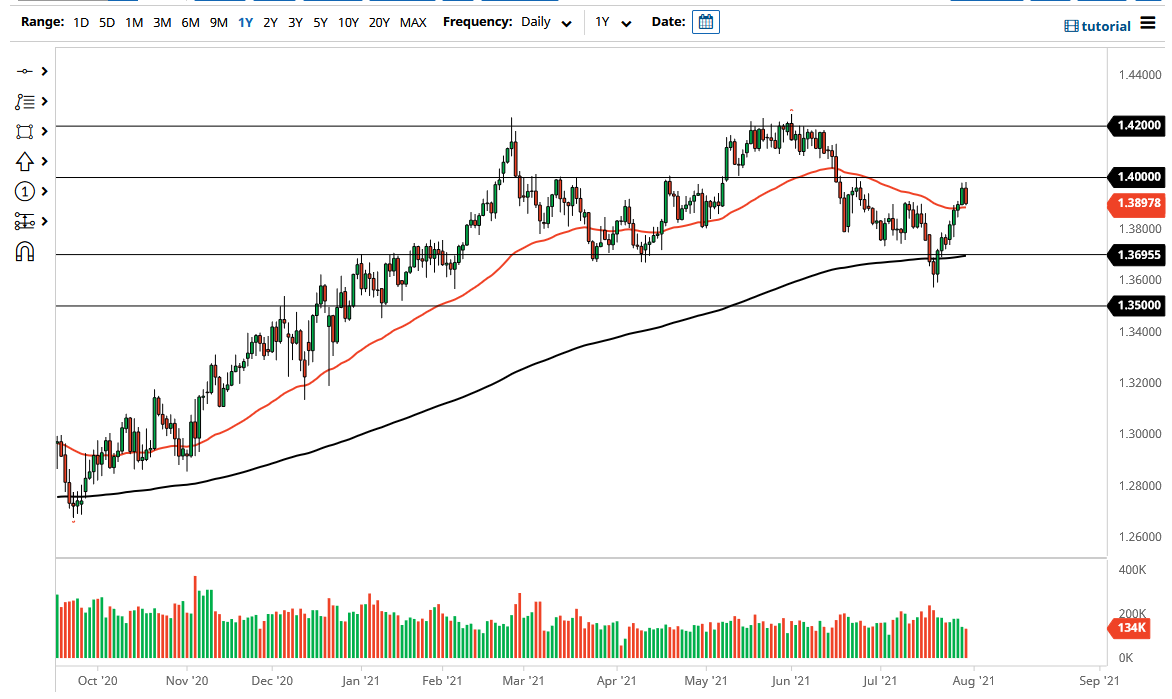

The British pound initially tried to rally during the trading session on Friday but continues to struggle at the 1.40 handle. This is an area that has been important more than once, so it should not be a huge surprise to see that we could not overtake it right away. As we are closing out the week, we are sitting on top of the 50-day EMA, so it will be interesting to see whether or not we stay here, but this should not be a huge surprise considering that there are so many moving pieces and it is possible that we could get a gap on Monday based upon some random headline.

Furthermore, you should also keep in mind that a lot of traders have to close out by the end of the week anyway, especially at prop firms. That will almost always cause a bit of noise at the end of the Friday session, as they have to flatten by mandate. Beyond that, the US dollar had gotten a little bit oversold, so I do not think it is a huge stretch to see this little bit of a pullback as healthy. We are currently sitting right around the 1.39 level, and I think that would be a potential support.

If we do break down below the 50-day EMA, it is likely that we could go down towards the 1.37 handle, which is a large, round, psychologically significant figure and an area where there is probably going to be a lot of interest based upon the recent bounce and the 200-day EMA. I think the next move is likely going to be choppy to say the least, but if we could get above the 1.40 handle it is possible that we could go looking towards the 1.42 level, which is a massive resistance barrier on longer-term charts. I do not necessarily see that happening easily though, as there is so much noise between here and there. As we head into August, it is probably going to be more range-bound than anything else if history has anything to say about it. With that, I will more than likely focus on short-term range bound trades.