The British pound initially pulled back on Wednesday but then turned around to show signs of strength again as the CPI figures in America came out as expected. Because of this, the US dollar sold off after that announcement, as a lot of traders were worried about inflation getting out of control. It is still very high in the United States, but it is not raging out of control like people had feared.

Because of this, it is possible that the market could go higher, but at the end of the day we still have much more likelihood of tightening coming out the United States than Great Britain, so it does make sense that we may fall a bit. At this point, the market is hanging quite nicely between the 50-day EMA and the 200-day EMA, which is an area that attracts a lot of attention in and of itself.

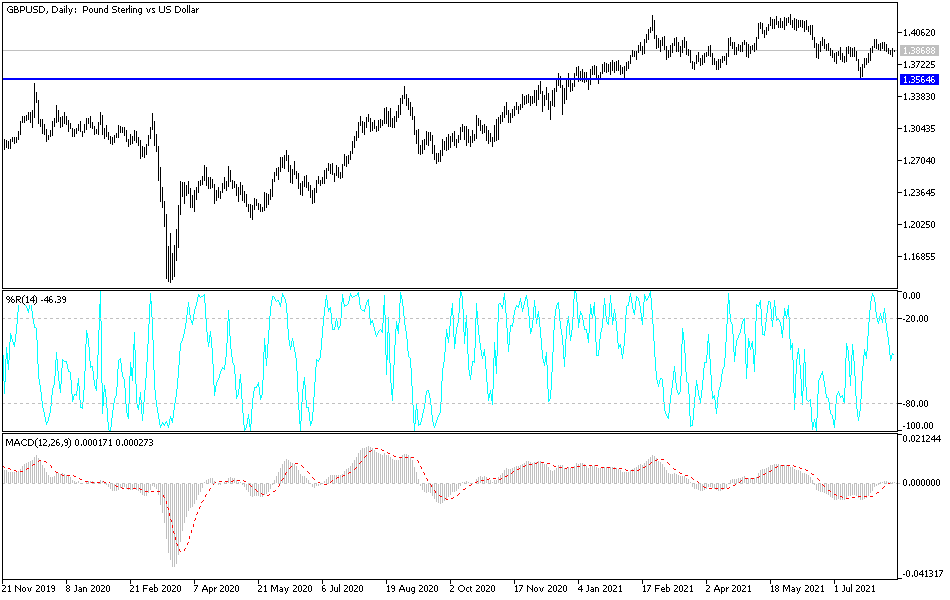

If we do break above that 50-day EMA it is likely that we could go higher, reaching towards 1.39 handle and then attempting to break above the 1.40 level. The 1.40 level is a large, round, psychologically significant figure that a lot of people will be paying close attention to, and it is important and has been very difficult to get above. When you look at the chart, you can make an argument for a bullish flag that had been forming, but we did get a little bit too far for me to get overly excited about that shape. With that being the case, I think it is only a matter of time before we have to make some type of bigger decision. If we break down below the bottom of the candlestick for the trading session on Wednesday, then it is likely that we will go looking towards the 1.37 level underneath.

As for the 1.37 level, it is an area that has attracted a lot of attention previously, and also has the 200-day EMA sitting right there as well. That is a longer-term indicator that a lot of people will continue to look towards to define the trend, so it is an area that typically offers a lot of support. Breaking down below there then opens up the possibility of a move down to the 1.35 handle.