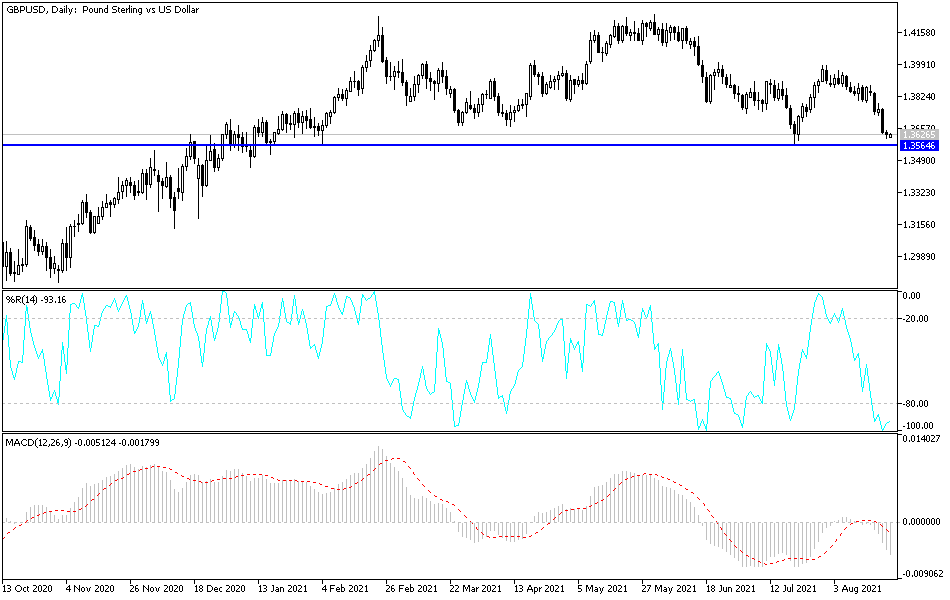

The British pound fell ever so slightly during the trading session on Friday as we dance around the 1.36 level. The market breaking down below the 1.36 level would open up the possibility of a move down to the 1.35 handle, which is a large, round, psychologically significant figure. If we were to break down below there, then it will simply be yet another reason to think that this market will go much lower. The market breaking down below the 1.35 handle will more than likely only accelerate the downside, as the US dollar continues to strengthen in general.

When you look at this chart, you can see that the 200-day EMA sits just above the 1.37 handle, which in my estimation is going to be somewhat significant resistance. I think at this point, the top of the Thursday candlestick is probably even more resistive, so unless we break above that level, I do not necessarily see a reason to get long. Breaking above that level would open up the possibility of a move towards the 50-day EMA, which is closer to the 1.3850 handle. That being said, we would need to see the US dollar losing strength against multiple currencies, not just this one.

As things stand right now, I believe that the market is very likely to continue going lower, and that short-term rallies will probably be sold into at the first signs of exhaustion. Pay close attention to the US Dollar Index, because if we continue to see talk of the Federal Reserve tapering, that will drive up the value of the greenback overall, and that should be seen in this area as well. The size of the candlestick tells me that we are at least trying to find some type of bottom, but unless something changes as far as risk appetite is concerned, I just do not see how we will bounce for a bigger move.

On a move down below the 1.35 handle, is very likely that the market will not only break down here, but we will see other currencies get hammered against the greenback as well, as we have already seen of the Australian dollar, euro, and many others. Another thing that a move towards the 1.35 handle accomplishes is that it makes a “lower low.”