The British pound initially rallied during the session on Tuesday but then turned around to fail as we have seen this market chop back and forth. I think that probably will continue to be the same over the next couple of days, because we just do not have any catalyst to make this market move between now and Friday. That being the case, the market is likely to be very noisy, especially considering that we have given back some of the initial gains.

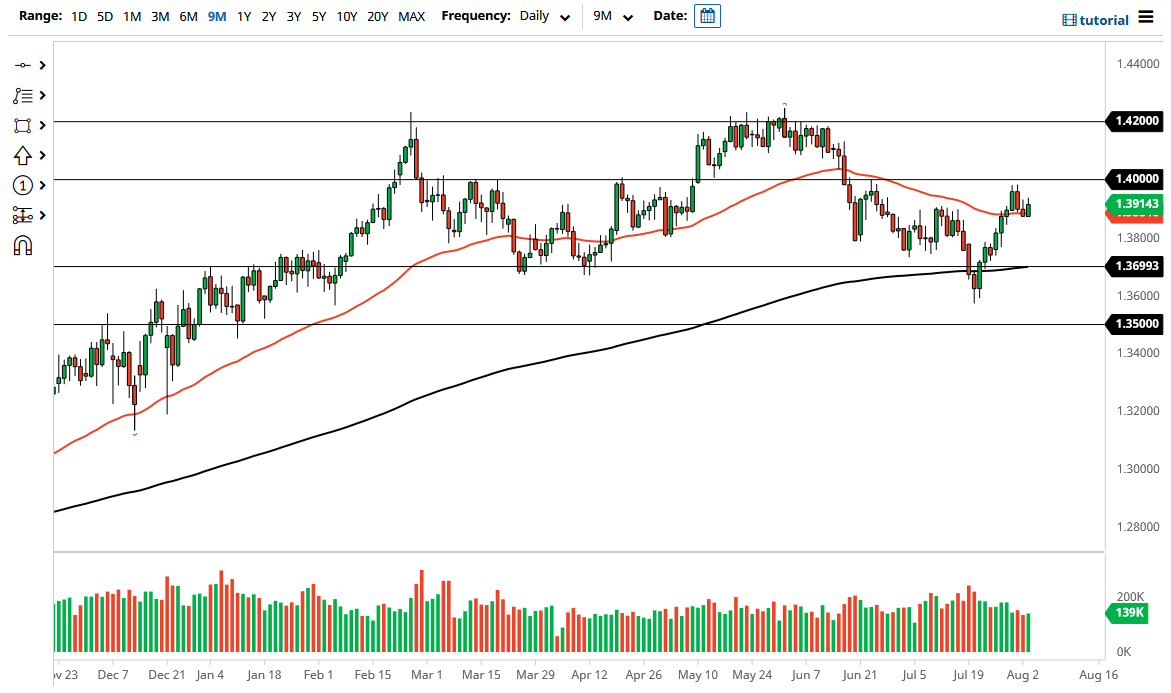

The 50-day EMA has been supportive over the last couple of days, but I think it would not take too much to make this market break down below there, as the market has recently taken to hanging around between the 50-day EMA and the 200-day EMA, which coincides with the 1.37 level, an area that has been important more than once, and where we bounced from previously. If we fall into this area, then I think it would simply be more of the same.

To the bullish side, you could take a look at this market through the prism of a short-term bullish flag, so if we break above the 1.40 handle, then it is possible that we could go looking towards the 1.42 level. The 1.42 level is a large, round, psychologically significant figure, but perhaps more importantly, it has been an area that has been resistance more than once. If we were to break above there, it would obviously be a very bullish sign, but right now I just do not see that happening and, more likely than not, we will hear plenty of noise above that will cause problems. At this point, this is probably a market that is going to move based upon the greenback more than the British pound, so keep that in mind as well.

We will probably see more short-term moves than anything else, so we will probably have to focus more on the smaller time frames between now and the jobs report. My anticipation is that we will see a much clearer picture at the end of the week if we get a clear picture at all. Pay close attention to the US Dollar Index and the 10-year note, because they also can have a major influence on where we are going.