Bearish View

Set a sell-stop at 1.3600 and a take-profit at 1.3500.

Add a stop-loss at 1.3700.

Timeline: 2-3 days.

Bullish View

Set a buy-stop at 1.3780 and a take-profit at 1.3900.

Add a stop-loss at 1.3700.

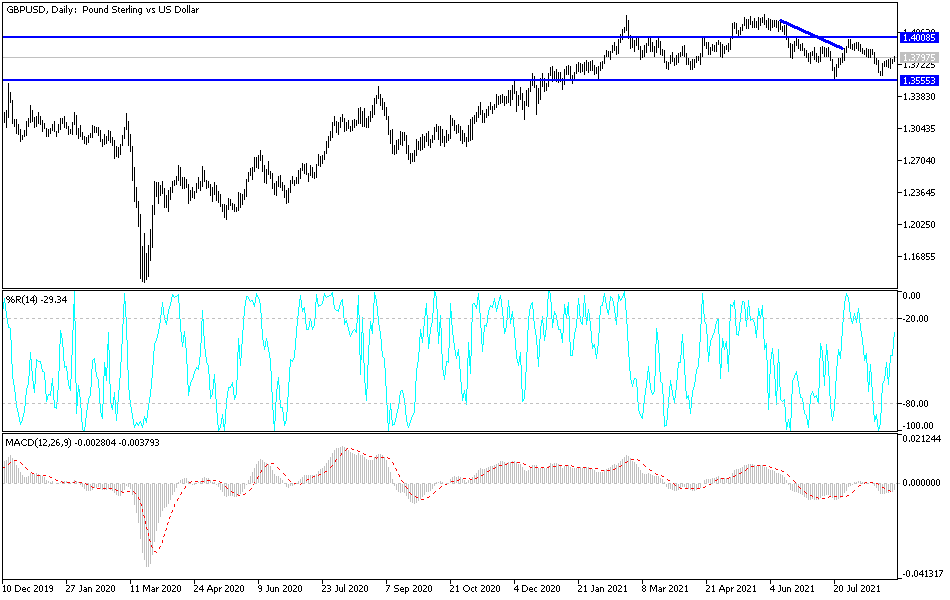

The GBP/USD price is in a holding pattern as the month comes to an end. The pair is trading at 1.3760, which is in the same range it has been in the past few trading sessions. The price is about 1.45% below the highest point in August.

Sterling in a Holding Pattern

The GBP/USD was in a relatively tight range in the overnight session as investors continued reflecting on the statement by Jerome Powell, the Federal Reserve chairman. In the statement at the Jackson Hole Symposium, the chairman said that the bank will likely start tapering its asset purchases in the coming month so long as the economy maintains its recovery process. This statement was seen by many analysts as being relatively dovish.

On Monday, the pair reacted to the latest pending home sales numbers by the National Association of Realtors. The data showed that pending home sales declined by 1.8% in July after falling by another 2% in the previous month. This decline was worse than the median estimate of 0.4%. The pending Home Sales Index declined from 112 to 110. Still, the American housing sector is relatively strong as evidenced by the recent new and existing home sales numbers.

The next key catalyst for the GBP/USD price will be the latest mortgage approvals numbers from the UK that will come out later today. These numbers are expected to show that the overall mortgage lending fell from more than 17.87 billion pounds in June to about 3.10 billion pounds in July. At the same time, mortgage approvals are expected to have dropped from more than 81.34k in June to 78.6k in July.

The other major catalyst will be the Conference Board’s consumer confidence data. Analysts expect the number to show that confidence declined from 129.1 in July to 124 in August. Just recently, data from Michigan University revealed that confidence declined to the lowest level since the pandemic started.

GBP/USD Forecast

The four-hour chart shows that the GBP/USD pair has formed an inverted cup and handle pattern. The lower part of this cup is at 1.3600, which was the lowest level in August. The price has also formed the handle section and is along the 25-day and 50-day moving averages. Therefore, while the pair has formed a small bullish flag pattern, there is a possibility that it will break out lower in the near term. This view will be confirmed if it manages to move below 1.3600.