The GBP/USD kicked off the week at the 1.3602 support, it's lowest of the year, but gained momentum and moved up to the 1.3747 resistance level as of this writing. The move comes as investors began giving up the US dollar ahead of the Jackson Hole symposium, and the pair is waiting for the momentum to complete the correction or continue in the direction of last week's trading. The currency pair may bounce back in the coming days if global markets continue to stabilize and the Jackson Hole Symposium evokes caution from bulls, although analysts indicate that the risk of the pound remaining under pressure exists.

The GBP/USD fell to an annual loss last week, which saw the pound surrender to the dollar its former status as the best-performing major currency for the year after British economic data came in below expectations and expectations grew that the policy shift of the US Federal Reserve is now well and truly in the making, and all of this came amid growing market concerns about the outlook for global growth.

"Our economists lowered their forecasts for third-quarter GDP growth in both the United States and China over the past week," says Zach Bundle, a Forex analyst at Goldman Sachs. “Given the significant role that global growth forecasts have played in the G10’s FX performance, we will need more confidence that delta-spreading outbreaks are waning before recommending a pro-cyclical US dollar sale.”

Significant Chinese economic numbers surprised on the downside for July last week and the previously outperforming New Zealand economy joined Australia in a fresh lockdown while Israel, one of the most vaccinated countries ever, is also reported to be hinting at the idea of a new "shutdown", in a triple blow to global economic prospects.

While global markets had stabilized before entering the new week’s trading, the US dollar rose against all currencies previously amidst virus-inspired risk aversion, and all currencies and markets will remain subject to cyclical instability when governments force economic disaster on their countries. However, the Fed's evolving policy outlook was also a driver of the dollar's move after the release of the July meeting minutes, and will be in focus again this week in light of Friday's speech from US Federal Reserve Chairman Jerome Powell at the annual Central Banking Governors Symposium in Jackson Hole at 15:00 London time in Wyoming.

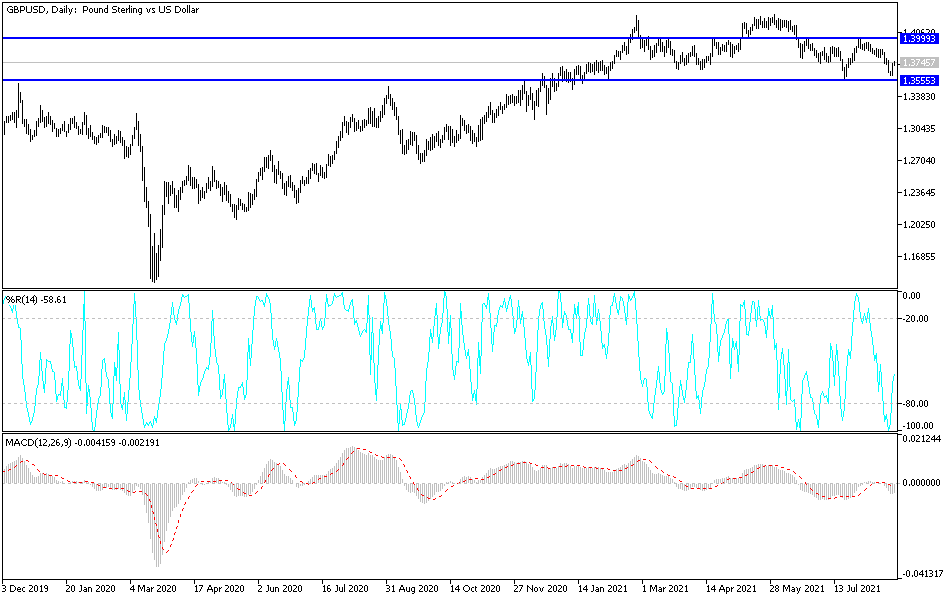

Technical analysis of the pair

On the daily chart, the GBP/USD currency pair still needs to breach the 1.3845 and 1.3920 resistance levels to get out of the current bearish outlook. If the pair moves below the nearest 1.3700 support, it may remain under this bearish pressure until Jerome Powell's comments at the end of the week.

The currency pair will be affected somewhat by the improved performance of global stock markets and investor risk sentiment. On the other hand, the negative results of the British releases will confirm the recent fears of the evaporation of the economic recovery. The best buying levels for the pair are currently 1.3670 and 1.3590.