In the wake of a weak US dollar, the GBP/USD was able to complete a correction upwards to the resistance level at 1.3800 as of this writing. Global stock markets are factors that negatively affect the pound's gains. The currency pair's gains could go further in the coming days if Friday's message from the Federal Reserve sends dollar bulls back during what's been a busy period of US economic data and a short holiday week in the UK.

The pound rose more than one percent against the dollar in one of its strongest weekly gains in months before the weekend, although it also saw its biggest one-week decline of the year against currencies such as the Norwegian krone, the New Zealand dollar and the Australian dollar. This was indicative of the scale of the US dollar's losses as well as the extent to which the latest batch of UK economic data has, at least temporarily, disrupted what had previously been the best performing currencies in the G10 segment of the Forex market.

“Powell's comments are less arrogant than some of his FOMC peers like Bostick, Kaplan and Pollard (to name a few)," says Mazen Issa, senior FX analyst at TD Securities. "The US dollar has responded accordingly. We think this could extend into next week, especially as we expect payrolls to be disappointing for the consensus. Indeed, the dollar remains sensitive to the ebb and flow of data.”

The dollar fell against other major currencies ahead of the weekend after a keynote speech by Federal Reserve Chairman Jerome Powell at the Jackson Hole Symposium - an annual meeting of central bankers and related professionals and academics - but also saw broad losses in the wake of the event, as global markets recovered from previous declines and demand for the safe haven of the dollar eased.

This week is quiet for UK economic data, but it does provide a slate of important US numbers that culminate in the release of the August non-farm payrolls report on Friday at 13:30, although it remains to be seen whether these will provide the same level of stimulus for the dollar has as they have done in recent months, given the implications of last Friday's speech from Jerome Powell.

Powell revealed that he was one of the majority of participants at the FOMC meeting in July who thought it might be appropriate to announce and begin the process of ending the Fed's quantitative easing program later this year, providing confirmation of the possibility. The dollar has appreciated in recent weeks and has acted as a headwind for the pound as well as other currencies.

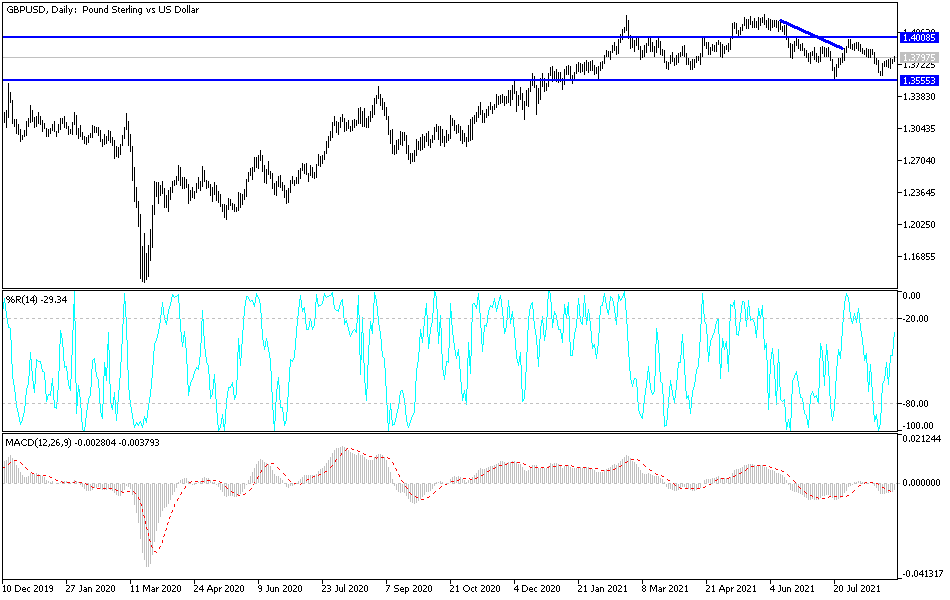

Technical analysis of the pair

The recent rebound attempts of the GBP/USD currency pair are still limited and in an initial stage of correction upwards. On the daily chart, the currency pair is a buying base waiting for a strong catalyst to launch strongly and reverse the general trend, which is still bearish, which may happen if the pair moves towards the resistance levels of 1.3885 and 1.4000. On the other hand, moving below the support at 1.3700 may restore a bearish push to move down again.

The pound will be affected today by the extent of risk appetite, the performance of global stock markets and the announcement of net lending to individuals in the United Kingdom, along with mortgage approvals.

From the United States, the Chicago PMI and US consumer confidence will be announced.