The strength of the US dollar contributed to a bearish performance for the GBP/USD, which headed towards the 1.3600 psychological support level. This may open the door for testing stronger support levels in the coming days if the current weakness factors persist. The British pound lost 1.75% over the course of last week's trading in what amounts to its worst weekly performance since mid-June. The decline in the GBP/USD is likely due to strong demand for the dollar, and is linked to concerns about slow global economic growth and continued expectations of interest rate hikes by the US Federal Reserve in the medium term.

Global stock markets headed for a fifth consecutive day of losses amid deteriorating global sentiment amid a sense that the post-crisis recovery in economic activity that characterized the 12 months from mid-2020 to mid-2021 will evaporate. A world of declining economic growth - while the US Federal Reserve looks to withdraw monetary stimulus - is a world that leaves no room for rising stocks, letting the dollar reap its gains. As a result, the outlook for the GBP/USD has deteriorated.

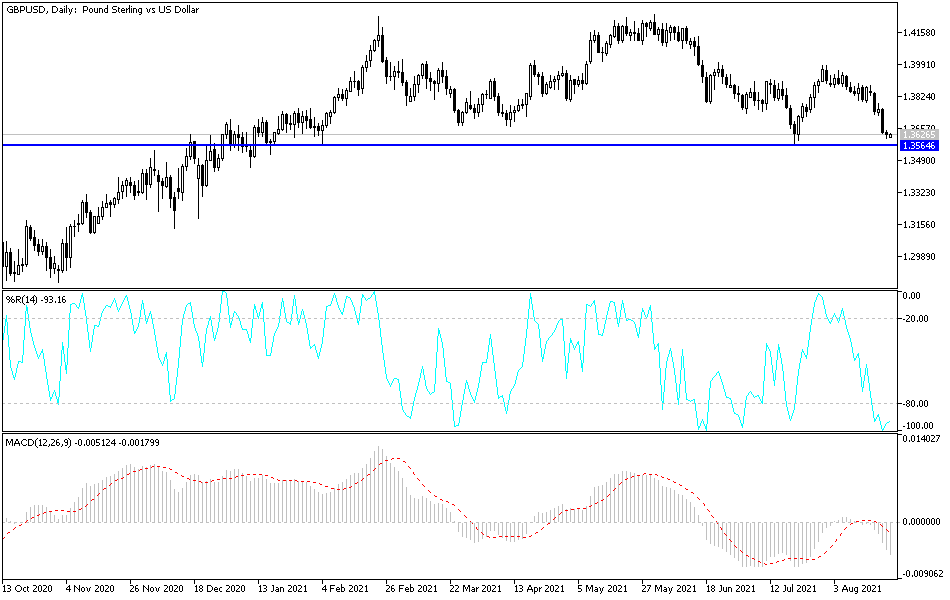

Commenting on the performance of the currency pair, Peter Stoneham, a market analyst for Reuters, says: “Technically, the charts have turned significantly against the pound, and if the dollar returns with its current advantage, the pound could drop a lot, which leads to major points of support.” Also, Karen Jones, Head of Technical Analysis Research at Commerzbank, says that the GBP/USD sell-off has already reached and eroded its April low at 1.3669, and will allow further losses to 1.3571, the July low. “There is long-term scope to return to the 200-week moving average at 1.3146. We have a 50% retracement level at 1.3457 from the upward move from September 2020.”

Moving averages are attracting attention, and a Reuters analyst says that technical analysts are excited about a possible crossover of the 50-day moving average below the 200-day moving average, a pattern called a death cross. "This signal could indicate a period of continued weakness," Stoneham adds. "The two averages converge and a crossover is likely unless the sterling undergoes a strong rebound from its current downtrend.”

Analysis indicates that the GBP/USD could influence the full price correction from 1.3573 to 1.3983 on July 20-30. Stoneham sees that “the minimum correction for the long-term rise from 1.1413 March 2020 low to 1.4250 June 2021 high comes before 1.3573 July low at 1.3580. Technically, these levels serve as viable targets for sterling.”

Despite the current optimism about the future of Fed policy, the strongest reason for the recent gains of the US dollar in the Forex market, the delay in tapering the US Federal Reserve policy may be caused by fears that a severe outbreak of the delta variable in the United States will lead to a slowdown in US economic activity, especially job creation. Since many states are seeing hospital intensive care units (ICUs) over-capacitated, this outcome is possible.

Technical analysis of the pair

There is a divergence in the direction of the technical indicators of the GBP/USD pair on the daily chart to reach oversold levels, indicating that there is another chance for further collapse. Currently, the closest support levels for the pair are 1.3590, 1.3520 and 1.3420. On the upside, the bulls will have control of the performance if they first move to the resistance level at 1.3775, and the gains of the pair will remain a target for selling if the current weakness factors continue.

The currency pair will be affected today by the announcement of the Manufacturing and Services PMI readings from Britain. Then the number of US new home sales will be released.