With buyers shying away from the US dollar until the Jackson Hole Symposium, the GBP/USD failed to move past the 1.3747 level and settled around 1.3715 as of this writing. The recent collapse of the currency pair pushed it towards the 1.3602 level, near its lowest of 2021 trading. The exchange rate recovered as FX analysts say the dollar may be due a period of consolidation before Federal Reserve Chairman Jerome Powell's appearance at Jackson Hole set to begin Thursday.

In this regard, Kenneth Brooks, senior analyst at Société Générale, said: “Technically, the dollar looks high and could be followed by a correction in the DXY index below 93.0 if Powell remains ambiguous about the timing and modalities for tapering.”

The US dollar is one of the best performing currencies in 2021 after it advanced against all other currencies as markets expect the Federal Reserve to reduce its quantitative easing program (tapering), a move that would precede an eventual rate hike. The timing of tapering remains one of the most important topics in financial markets and will ultimately help determine how the dollar trades for the remainder of 2021. On this milestone, Anders Eklöf, chief currency analyst at Swedbank, says he is expecting a pause in the dollar's rally this week, as Jackson Hole will not provide the fuel needed for the bulls to press on new gains.

"Powell is unlikely to provide any consistent policy details about the time frame and pace of tapering rather than detail about policy in general," Ekloff said.

The consensus among analysts is that the Fed will signal a pullback at its November meeting and begin the process in December. However, the September call cannot be ruled out, a development that will be on the supportive side of the dollar dynamics. But the Kansas City Bank announced last week that it will be holding a Jackson Hole symposium around the corner, a timely reminder that the delta version of COVID-19 is increasing infection rates across the United States that could dampen the economic recovery and prompt the Federal Reserve to pause and reconsider.

Thus, any pullback may provide dollar-buyers an opportunity to make gains, especially given the general sentiment that still exists that the US currency has the potential to advance in the medium term (the coming months). The US dollar has already dominated this year and is maintaining its gains against all of its peers in the G10, with the exception of the Canadian dollar and the British pound, which incur losses against it as small as half a percent.

Recently, the safe-haven characteristics of the dollar emerged during the past week amid intense selling in global stock markets, linked to fears that the spread of the delta variable will weaken the economic recovery in regions such as China and Southeast Asia.

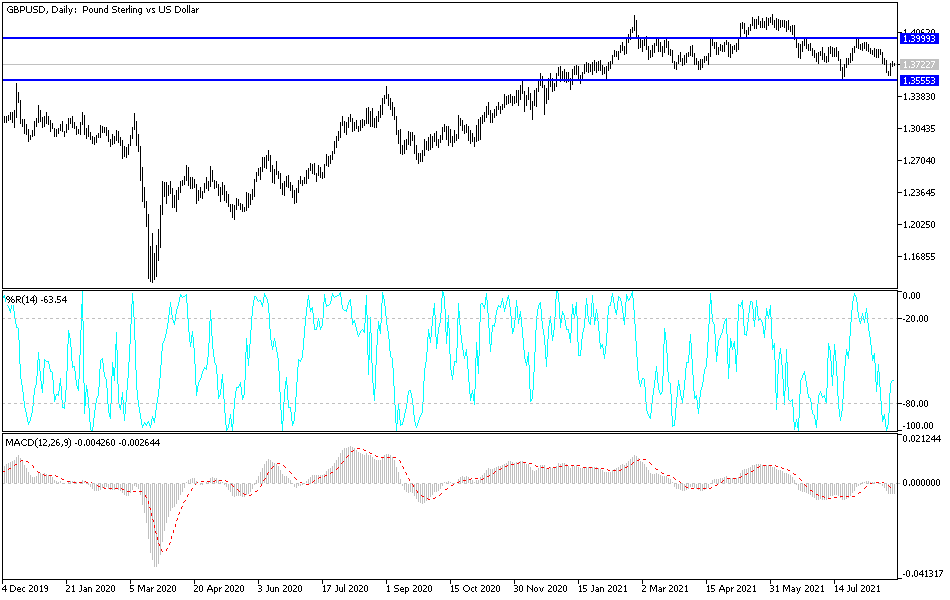

Technical analysis of the pair

A break through the crucial 1.3845 resistance will motivate the bulls to rush towards the 1.4000 psychological resistance level to fully end the bearish trend. The current trend may move the currency pair towards the support levels 1.3675 and 1.3580.

The pound is not awaiting any important British data today. From the United States of America, durable goods orders will be announced.