The US dollar was temporarily stalled ahead of the Jackson Hole Symposium, allowing the price of the GBP/USD currency pair to correct upwards. The pair reached the level of 1.3768 before settling around the 1.3740 level as of this writing. The rebound came after the currency pair tested the support level at 1.3602 last week, near its lowest of 2021. The strong dollar movement this week along with expectations of slowing US economic growth has faded as the Delta variant dampens activity in the world's largest economy. The dollar has long benefited from the US economic exception, and signs that these exceptions may diminish could erode support for the dollar. With that in mind, Federal Reserve Chairman Jerome Powell's speech at the Jackson Hole symposium is scheduled for Friday. It is expected to address the issue of the Fed's planned withdrawal of stimulus, and more specifically reducing the size of its quantitative easing program.

The strength of the US economic recovery means that the Fed's ultra-supportive monetary setups are no longer required, and if anything they risk creating asset bubbles that could destabilize the economy in the future. Expectations are for Powell to indicate that a decision on "tapering" quantitative easing will be made at the next meeting of the Federal Reserve, an expectation that has been largely supportive of the dollar in recent weeks.

But, Powell may also sound a warning about the economic outlook due to the spread of the Delta variant, a development that could take some heat out of the dollar.

US consumer confidence data for August showed a dip below pre-pandemic levels, falling to the lowest level since December 2011. Meanwhile, US retail sales fell more than expected in July, including and excluding auto sales. Meanwhile, IHS Markit PMI data on Monday showed private sector growth in the US slowed sharply in August as supply chain and capacity constraints persisted, and the pandemic variable added a new negativity to the mix.

The latest data showed a slowdown and Powell is likely to admit that. So while the economy is still growing, there is less urgency for the Fed to introduce the timing of its tapering, and this may provide reason to undo the recent dollar strength.

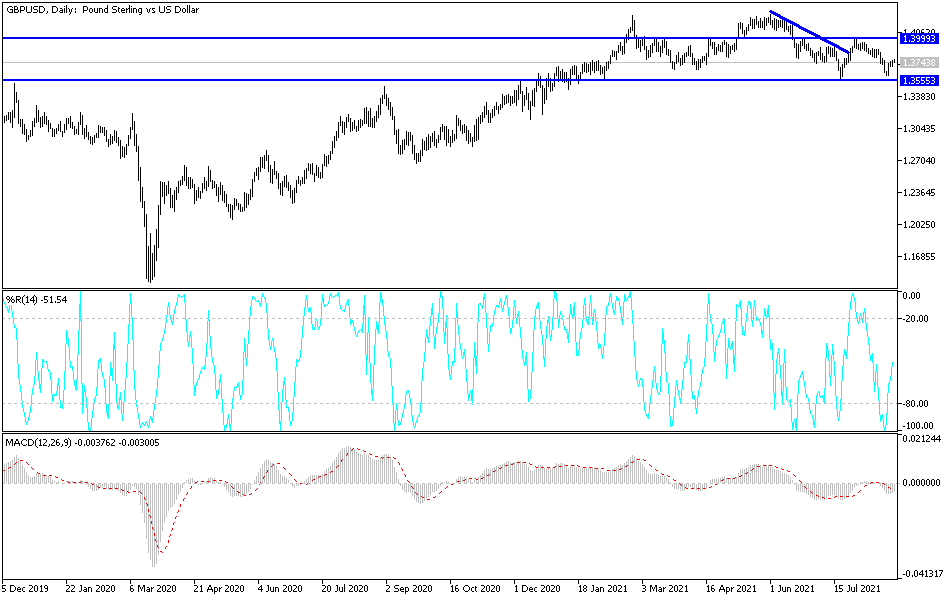

Technical analysis of the pair

On the daily chart, the GBP/USD is still at the beginning of a bearish phase and will not succeed in creating an actual shift in the current trend without breaching the 1.4000 psychological resistance that stimulates more buying. So far, the pair is still closer to settilng below the 1.3700 support that would move the pair towards stronger support levels, the closest of which are currently 1.3675 and 1.3580.

All the focus of the currency pair today will be on risk appetite, the announcement of the growth rate of the US economy, the number of weekly jobless claims, as well as the reaction from the numbers of infections.