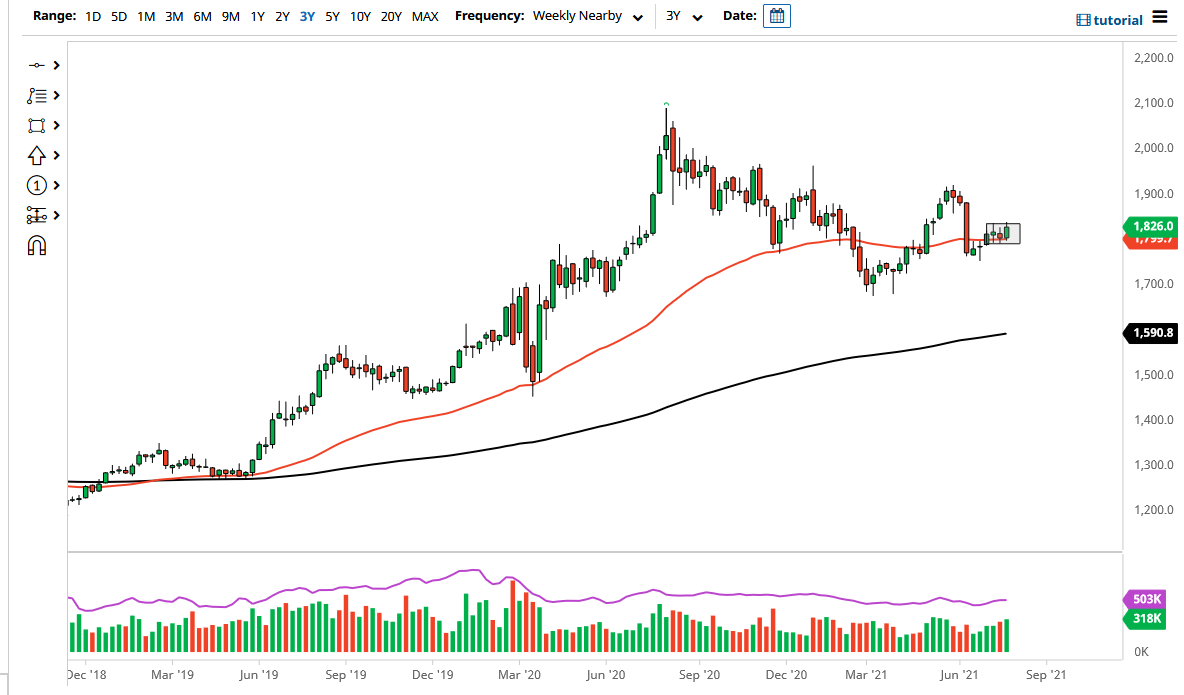

Gold markets are building up for a move, and we could see that move come in August. After all, we have been stuck in a small trading range, with the $1790 level underneath offering significant support. On the other hand, the $1830 level offers significant resistance, and we have essentially been stuck in this range over the last 30 days or so. With that being the case, the market looks as if it is trying to build up enough inertia to take off in one direction or another.

Looking at the candlestick for the last week of July, at looks as if we are trying to build up the necessary momentum to break out and go higher. The massive red candlestick on the weekly chart from two months ago would be a target if we could get to the top of it, which is roughly $1880. On the other hand, if we were to break down below the $1790 level, it is likely that the market then would go looking towards the $1750 level. The $1750 level was a major turnaround for the market, considering we had sold off so hard and then turned right back around in that general vicinity.

If we were to break down below the $1750 level, then it is likely that the market would go looking towards the double bottom down at the $1680 level. That is an area that I think will be very difficult to break below, but if we do, then the whole thing is going to fall apart. That being said, I think the most likely move next will have a significant negative correlation to the US dollar, as it is typically the way this market moves.

With that in mind, pay close attention to the US Dollar Index, because if it starts to drift lower, that should help gold. When you look at the longer-term chart, you can see that we have been chopping back and forth over the last several months, and while gold looked as if it was going to fall off a cliff several months back, we have made a strong attempt to recover. If it were not for that nasty red candle two months ago, the weekly chart would look very strong. There is a lot of noise out there when it comes to the inflation/deflation debate and whether or not it is going to be a “transitory situation.” Because of this, I do not think that gold will break too many of the barriers mentioned.