Gold markets rallied significantly on Friday as Jerome Powell gave his speech from the Jackson Hole Virtual Symposium. As he was a bit more dovish than some of the other Federal Reserve members, it suggests that the Federal Reserve will continue to keep monetary policy loose enough to give gold a chance to break out. After all, even though there may be a little bit in the way of bond purchase tapering, the reality is that interest rate hikes are light years away, and at this point it gives the green light for gold to go much higher.

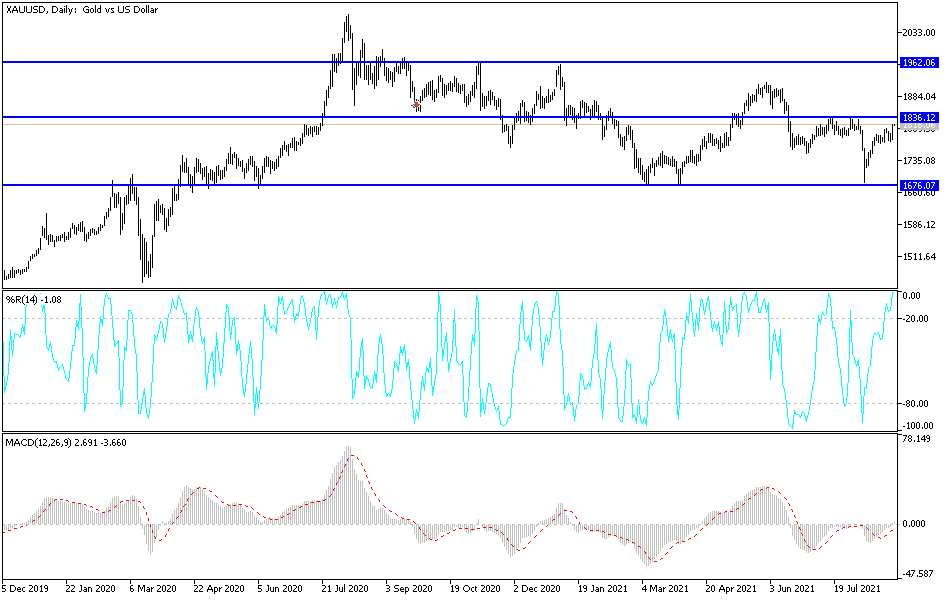

Gold markets were closing towards the top of the range for the session as well, and that is a very bullish sign. The $1830 level above offers resistance, as it has for several months now. If we were to break above that region, it is likely that the market could go looking towards the $1910 level, possibly even much further than that as it would be an extraordinarily bullish sign for the metal.

Keep in mind that the US Dollar Index need to be followed very closely, because there is a major negative correlation between the two markets, and as a result I think what we will see here is the possibility that the markets are going to go looking towards the $1830 level and ask a lot of questions at that point. On the other hand, if we were to see sudden US dollar strength, we could see the gold markets fall apart, sending this market back down towards the $1780 level. After that, then the $1750 level comes into the picture, which has been supportive more than once.

If we were to somehow break down below the $1750 level, then it is very possible that gold will go looking towards the $1680 level where we had seen a major support level form multiple times, and breaking that would be disastrous. That would almost certainly be a major run towards the greenback, something that looks less likely after the Friday action played out. With this, buying the dips probably continues to be the best way forward in this market as we have seen so much in the way of power during the trading session on Friday.