Gold markets broke higher on Friday above the $1775 level. More importantly, the market had recovered all of the losses from the horrific Monday opening, which saw gold lose much as $100 in roughly 20 minutes. By wiping out all of that fear and selling pressure, it is a very bullish turn of events, but I also recognize that there are a lot of sellers above waiting also. However, please keep in mind that the weekly candlestick is now a vicious-looking hammer, which means we could see more money flowing into this market.

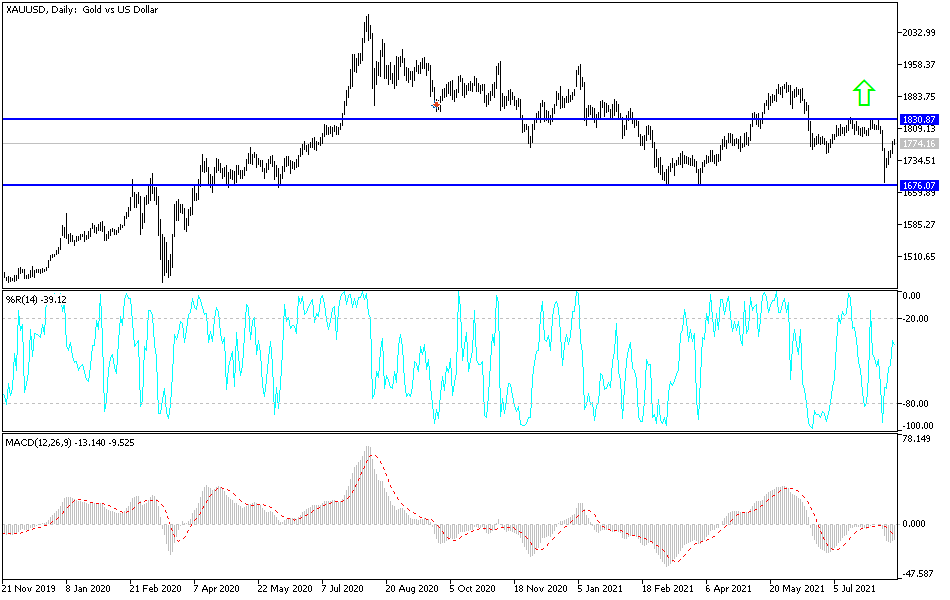

Yields in America have dropped a bit, and that certainly has helped the gold market because at least now you are paid as much to hold paper as you once were. One yields spike, gold typically struggles a bit due to the fact that you need to pay for storage. However, the yields dropping do not necessarily mean that gold will do well; it depends on what the reasoning is. Nonetheless, we have seen the correlation play out this week, so one has to keep that in mind. Just above, the $1800 level has a significant amount of support that previously had been crushed, which should now act as resistance. We have the 50-day EMA sitting in that same general vicinity, having just crossed below the 200-day EMA to form the “death cross” that a lot of people will pay attention to longer term.

If we were to turn around and break down below the neutral candlestick from the Thursday session, that would be an extraordinarily negative turn of events, and could send this market towards the lows again. However, the Friday candlestick does offer a certain amount of confidence, so I think what we have here is a huge battle just waiting to take place. The US dollar could be key as well, so pay attention to what is going on in the US Dollar Index, as there is a strong negative correlation to gold most of the time. The size of the candlestick is impressive, so I would be a bit surprised if we did not at least try to go a little higher before sellers got involved.