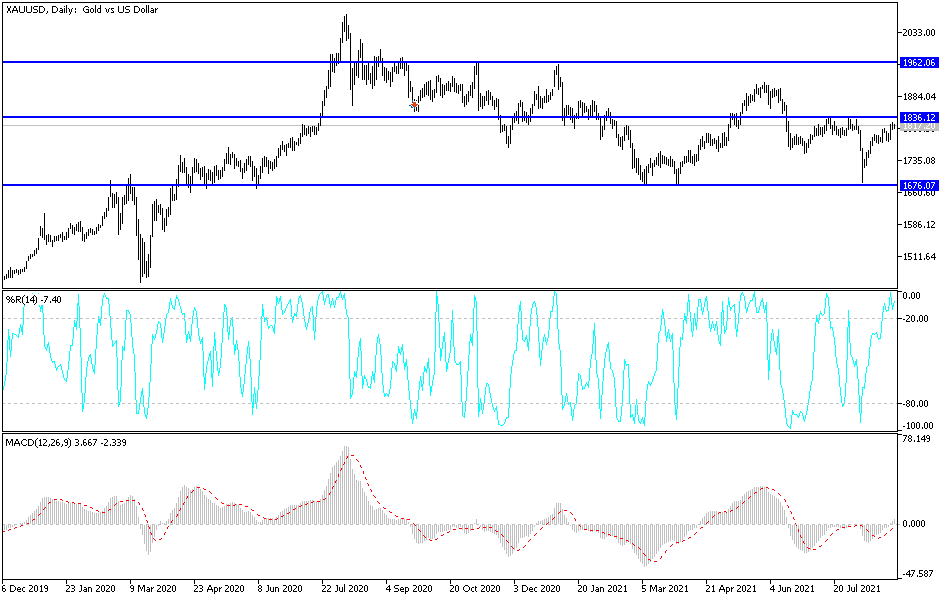

The gold markets rallied just a bit on Monday but then turned around as we have seen a bit of selling pressure. Ultimately, this is a market that sits above the 200-day EMA and that is something, but keep in mind that the 200-day EMA is flat, which suggests that we have nowhere to go in the short term. Ultimately, this is a market that looks as if it is trying to figure out where to go longer term, and with the jobs number coming on Friday, it makes sense that we would give back some of those initial gains, as risk will be a major thing to keep in the back of your mind.

The US dollar will have its own influence on this market, as it does tend to move in a negative correlation. The 200-day EMA is flat as I stated, but the 50-day EMA is sitting just below there and going sideways as well. If we were to break down below the candlestick from the trading session on Monday, then the market will open up a move down to $1750 underneath. If we were to break down below there, the market could very well go looking towards the $1680 level next. At that level, we have seen a lot of support at in the past, so it makes sense that it would make a target. If we break down below there, then the market would fall apart and perhaps go looking towards the $1500 level.

To the upside, if we were to turn around and break above the $1835 level, then it is likely that we could go looking towards $1865 level. After that, the market is likely to go looking towards the $1865, and then possibly the $1910 level. Obviously, that would be negative for the US dollar, and perhaps a lot of influence by the bond markets, as interest rates have a major influence on where we go in this market as well. Ultimately, I think that the next couple of days will be very noisy and I think somewhat range-bound. If the market were to get news that moved risk appetite drastically, then we might have a bit of its change, but between now and the jobs number I do not expect much.