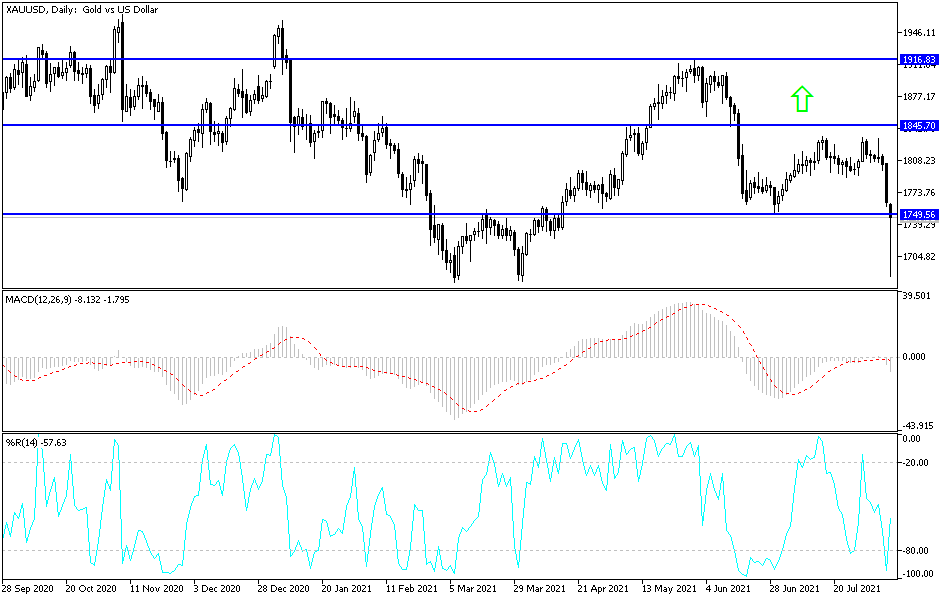

Gold markets got crushed during the Friday session on higher yields coming out the United States as 943,000 jobs were added to the payrolls during July. At this point, it will be interesting to see how this plays out, because we are approaching major resistance. That being said, the nasty shape of the candlestick suggests that there are lot of sellers out there just waiting to jump in as well. I think a lot of people that were banking on gold strengthening are probably in serious trouble at the moment.

With this being said, the market will continue to look at the $1750 level as significant support, and if we were to break down below there it is likely that we would go much lower, perhaps reaching down towards the $1680 level where we had formed a double bottom previously. This is a market that was going sideways and not doing anything for what seems like eternity. Now that we have made this move, it is very likely that we will continue to see traders coming into play this market every time there is a little bit of exhaustion.

I do not have any interest in buying gold anytime soon, unless we see a sudden reversal in the US dollar and, more importantly, the bond yields. Keep in mind that it has an outsized influence on gold due to the fact that it is easier to hold paper than it is to hold massive amounts of precious metals. If interest rates continue to rise, that will put even more pressure on this market, perhaps causing a bit of a downdraft.

If we were to turn around, it would not be until we get a daily close above the 200-day EMA that I would consider buying, and even then, I would have to take a look around at the entire macro picture in order to give you an idea as to whether or not I would put any money to work. I suspect that this week we will probably look for long wicks to the upside to start selling after short-term bounces. If we do break down below the support right away, that signals that gold is going to enter a very troublesome trend and fall apart significantly.