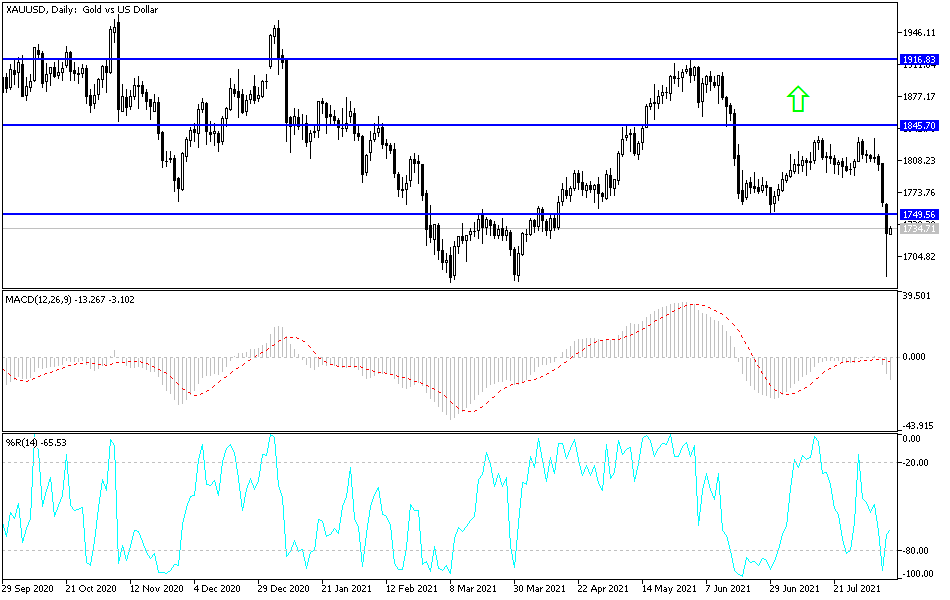

Gold markets crashed to kick off the trading week as Asians reacted to the rising interest rates in America and the massive selloff that gold had seen on Friday. In fact, the market crashed all the way down towards the $1680 level, which is an area that I was paying close attention to over the last couple of weeks, and I've mentioned the double bottom in that area multiple times. The fact that we bounced from there is a bullish sign, but at the same time you can also make the argument that we got there in about 30 minutes, which means that we were never truly going to be able to break through all of the order flow in that area.

That does not mean that we cannot do it in the future. Because of this, I am paying close attention to the $1750 level and signs of exhaustion in that area on shorter-term charts. In fact, I am waiting to see some type of exhaustive candle on the shorter-term charts such as the 15-minute chart that shows that we are rolling over to start shorting again. At that point, I think we will go looking towards the $1680 level to try to break down through there and go looking towards the $1500 level. The key to this is going to be the 10-year interest rate coming out of the United States, because if it continues to go higher, that means that gold will become much more expensive there due to the fact that the bond markets will pay a return in interest and gold will actually cost money due to storage fees.

As far as buying is concerned, I would need a couple of different things to happen, not the least of which would be the US interest rates to stabilize. If they start to fall again, that might give gold the chance that it needs to go higher. Furthermore, you have to keep in mind that the US dollar continues to be a major driver in general, as gold is typically negatively correlated to this market. I would need to see a daily close above the top of the candlestick for the trading session on Monday to even remotely consider buying, and even then, I would be a bit concerned around the 50-day EMA and the 200-day EMA as well.