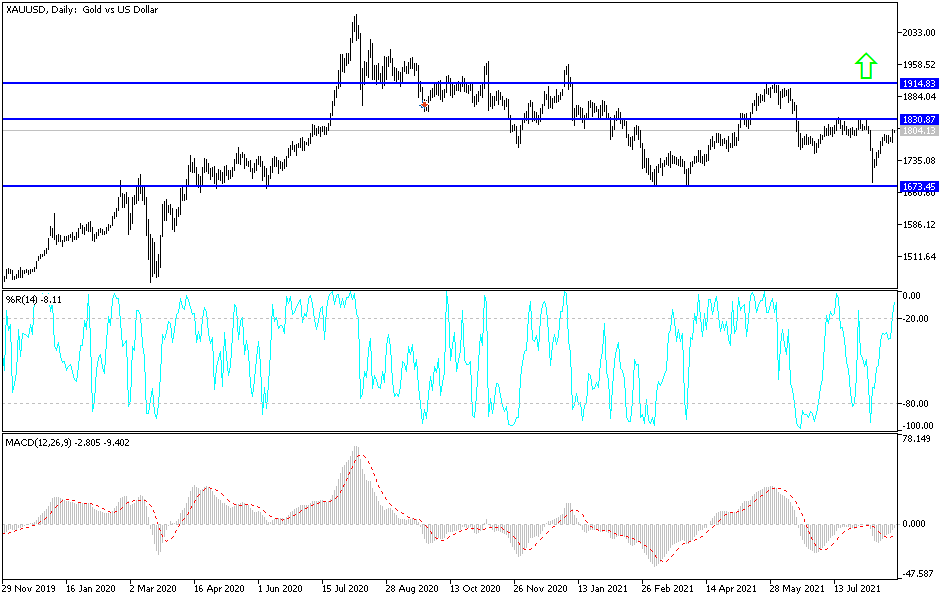

Gold markets rallied significantly on Monday to break above the 50-day EMA, and closing towards the top of the candlestick is a very positive sign. The fact that we are closing towards the top of the candlestick for the session also suggests that there could be a bit of follow-through, but we are most certainly seen a lot of resistance just above that could jump into the fray.

All this being said, it is about the US dollar. Gold has almost nothing to say at this point, because it is not a matter of wanting to hold gold or even fight inflation with the yellow metal, it is a reaction to the US dollar in general. The US dollar was hit rather hard during the Monday session, and it does make sense that we would see this market move in a negative correlated way. After all, the market continues to see the US dollar move in the opposite direction. The candlestick certainly suggests that we have bullish pressure ahead of us, but at the end of the day there is a lot of noise between here and the $1830 level, and I think it would be a bit much to simply expect this market to slice through that level.

If we were to break above the $1830 level, then it is likely that we could go looking towards the $1910 level, an area where we have seen a lot of resistance previously. Breaking above that then allows the market to go much higher, perhaps on a longer-term “buy-and-hold” type of attitude. Ultimately, I think that the market will have to pay close attention to the Jackson Hole Symposium, because we will be looking at the possibility of tapering talk to move the greenback, which by extension will move this market. It appears that people are betting that Jerome Powell is going to come to save the day by offering plenty of liquidity going forward, and thus saving Wall Street. That should then drive down the value of the dollar, assuming it is true. However, if he reiterates some of the talk that we have seen from various Federal Reserve governors around the country, it is possible that we may see a nasty reversal during the statement.