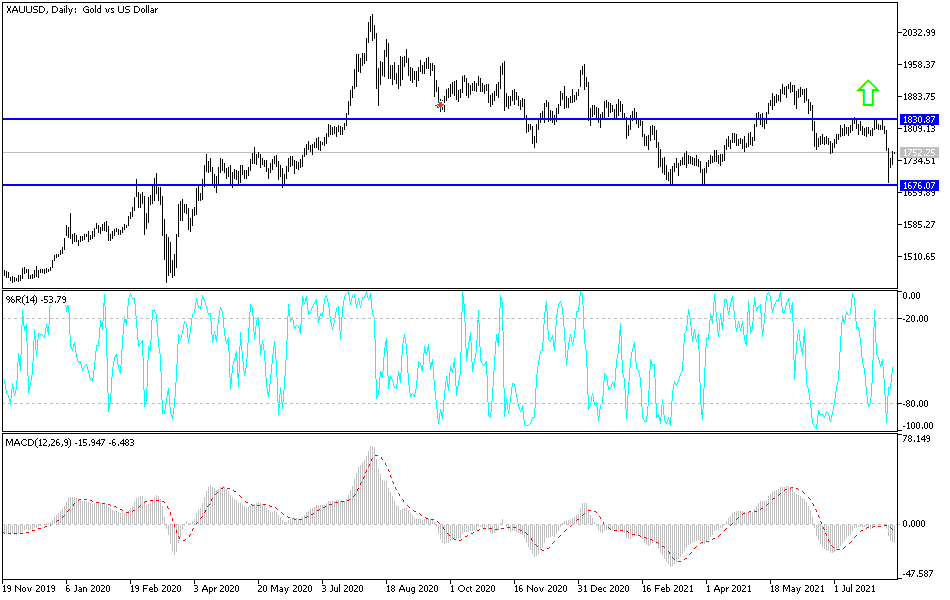

The gold markets rallied a bit on Wednesday after the CPI numbers came out as expected. Because of this, the US dollar sold off, and we have seen strength in the gold market ever since. That being said, there are a lot of concerns out there when it comes to inflation, although it seems as if the inflationary story leaves a little bit to be desired. Nonetheless, keep in mind that we will have to pay close attention to the 10-year note and interest rates.

Beyond all of that, the market had recently sold off quite drastically, so even though we have had a good day on Wednesday, the reality is that we have not wiped out quite a bit of selling pressure yet, and although we have had a nice bounce, it is still just shy of 50% since the fall. Furthermore, we have to pay close attention to the greenback in general, because if it does strengthen, it is likely that the gold market will roll right back over.

On the other hand, if we were to break above the hammer from the Monday session, that might bring in enough momentum to have the market looking towards the $1800 level. The $1800 level also features the 200-day EMA and the 50-day EMA. In other words, there are lot of technical issues in that general vicinity. Furthermore, we are closing towards the top of the daily candlestick, and that is something else to pay attention to. I think there is a significant opportunity for volatility, so you will need to be cautious about your position. Because of this, I think this is a market that will be worth watching, if for no other reason than it could give you an idea as to how the currency markets will play out. In general, I think this will be one of your more important markets to pay attention to and, with that being the case, it is likely that we will see a lot of inflow in one direction or the other. Once we finally get more of an impulsive signal, then we can put serious money to work.