Gold markets fluctuated on Tuesday as we continue to look at the gold market through the prism of whether or not inflation is a major issue. The CPI number coming out on Wednesday might have something to say about where we go next as well, because if the inflationary numbers are too strong, it may make the yields spike in America. As a general rule, if the fear of inflation is starting to stoke the idea of the Federal Reserve tightening, it makes the idea of holding paper much more palatable than paying for storage when it comes to gold.

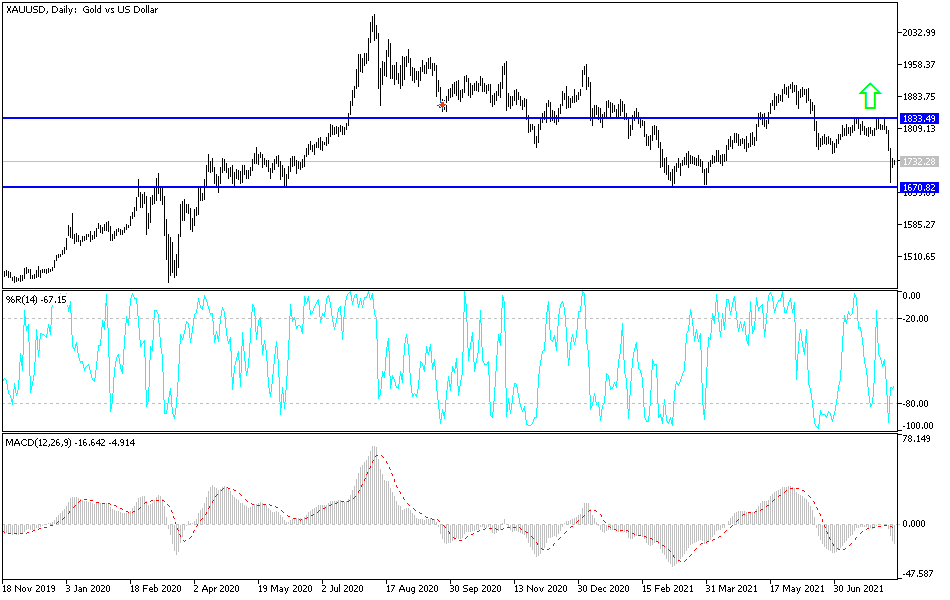

The market will be paying close attention to the $1725 level, which is an area that attracted a bit of attention over the last couple of days. The market breaking down below the lows of the trading session on Tuesday would open up a move towards the crash low from the Monday sellout. That is the $1680 level, an area that is important because we had formed a double bottom there previously. With that being the case, the fact that we could not break through there right away was not a huge surprise, and now it is very possible that the market may have to drop down towards that area in order to test that area.

On the other hand, if the CPI number misses, then there will not be concerns about inflation necessarily, so I think it could be good for gold as the yields will not pay as much to hold paper and a “yield-less asset” might be a bit more attractive. Either way, I think that we have a significant move just waiting to happen, and as a result, I think that by the time we get done with the CPI announcement, there should be some type of move that we can start to follow. If we take off to the upside, meaning that we were to break above the $1750 level, then we could go looking towards the 200-day EMA above. On the other hand, I think it is going to be much easier to sell this market than to buy it, but we need to get that announcement out of the way.