The weakness of the US dollar after the Jackson Hole Symposium contributed to a strong upward rebound for gold. The metal shot to the resistance level of $1819, a 3-week high, where is settled at the beginning of this week's trading. Gold prices recorded weekly gains of more than 1.55%, and thus reduced its loss in 2021 to less than 5%. Silver, the sister commodity to gold, is trying to reach $24. Silver futures rose to $23.90 an ounce. Accordingly, the price of the white metal got a weekly gain of more than 4%, which reduced the decline in the price of silver during the year 2021 to less than 10%.

Commodity gains are holding steady, though the Federal Reserve expects it may start tapering its very aggressive quantitative easing (QE) program by the end of the year. But there may be optimism about gold amid expectations that interest rates will remain near zero next year.

Gold has found additional support for a critical measure of inflation, which is running at its highest level since the early 1990s. According to the Bureau of Economic Analysis (BEA), the PCE Price Index rose at an annualized rate of 4.2% in July, up from 4% in June. The core PCE Price Index, which strips out the volatile food and energy sectors, was unchanged at 3.6% year-on-year to start the third quarter.

During the Jackson Hole seminar, Jerome Powell said, "The timing and speed of the next reduction in asset purchases will not be a direct indication as to the timing of the rate hike, which we have formulated a different and considerably more stringent test. We have said that we will continue to maintain the target range for the federal funds rate at its current level until the US economy reaches conditions compatible with maximum employment, inflation has reached 2 percent and is on the way to moderately above 2 percent for some time. We have a lot of ground to cover to reach maximum employment, and time will tell if we reach a 2 percent inflation rate on a sustainable basis.”

Kit Juckes, head of Forex research at Société Générale, made clear in a note ahead of Powell's speech that the market was expecting a faster march to rate hikes once tapering was complete. “If tapering is officially announced in November and starts in December, it will be ‘finished’ in July, and could hint at a price hike in Jackson Hole and the first price move could happen as early as Q4 2022,” he said. "If that happens, they will announce a formal tapering at the September FOMC meeting and start in October, that could be done in May and could raise rates before the summer.”

In terms of influences on the gold market: The US Dollar Index (DXY), which measures the performance of the US currency against a basket of major currencies, fell to 92.71, and it has to move towards a weekly loss of about 0.85%, which is good news for commodities priced in dollars because it makes buying it cheaper for foreign investors. Also, the US bond market was mostly in the red by the end of trading, with the benchmark 10-year yield dropping to 1.314%. One-year bond yields were flat at 0.066%, while 30-year yields fell 0.013% to 1.928%.

Relative to other metals markets, copper futures rose to $4,301 a pound. Platinum futures rose to $1,001.90 an ounce. Palladium futures rose to $2406 an ounce.

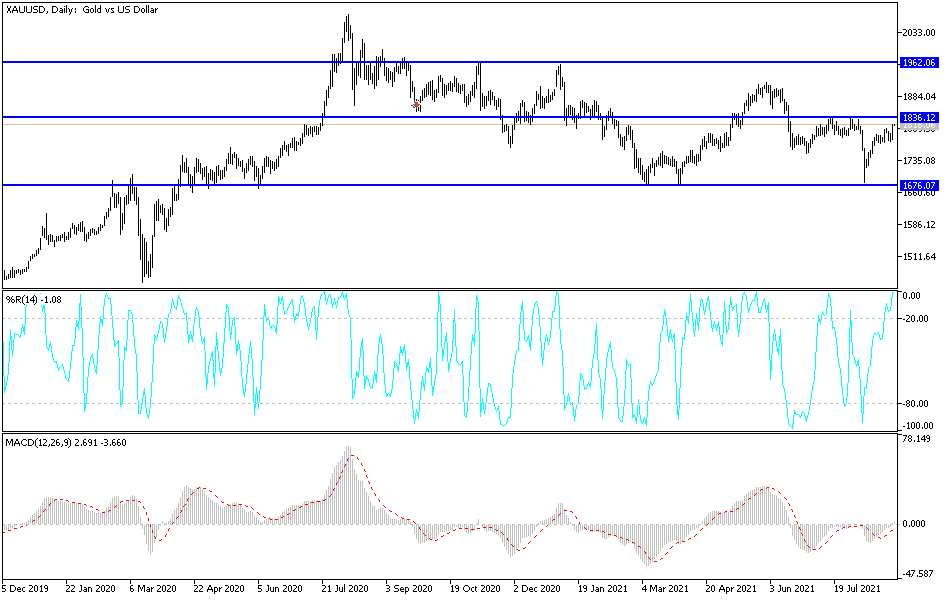

Technical analysis of gold

We had noted before that the psychological resistance level of $1800 will stimulate the bulls amid technical buying to move towards higher levels, and as gold reached the first expected level of $1819 we are on a trajectory towards $1827, $1827 and $1845. This may happen quickly if the weakness of the US dollar continues, along with concerns about the Delta variant, leading to economic closures.

On the downside, the bears will not regain control of the performance without moving towards the support at $1795 first, then to $1780 and $1772. The price of gold may maintain its gains to some extent until the announcement of the important US jobs numbers this week.