The US dollar declined at the end of last week's trading, which allowed gold to move to the resistance level at $1780. The gold commodity achieved a weekly gain of about 1%, reducing its loss since the beginning of the year 2021 to less than 7%. Its gains came after gold prices were in a downward spiral this month, driven by positive economic data and a possible pullback by the US Federal Reserve's policy.

The price of silver, the sister commodity to gold, rose to $23.775 an ounce last week. Despite that, silver recorded a weekly loss of 2.25%, in addition to its decline in 2021 by 10%.

The main contributor to the rise in gold prices on Friday was the University of Michigan Consumer Confidence Index, which fell to a reading of 70.2 in August, the lowest level since the early days of the COVID-19 public health crisis in April. This was also down from a reading of 81.2 in July. Meanwhile, a weaker US currency helped lift gold futures contracts which, according to several market analysts, were in "oversold territory". The US Dollar Index (DXY), which measures the dollar's performance against a basket of six major competing currencies, fell to 92.49, and the index recorded a weekly decline of 0.3%. Its double earnings are good for dollar-denominated commodities because it makes them cheaper to buy for foreign investors.

In recent weeks, it has become widely expected that the Federal Reserve will begin to scale back its $120 billion per month quantitative easing (QE) program. With inflation rising and the labor market recovering, many Fed officials are advocating the normalization of policy and possibly raising interest rates by the end of the year. For now, Federal Reserve Chairman Jerome Powell has signaled that all will remain, stressing that he wants to see the coronavirus pandemic away in the rear-view mirror before scaling back policy.

Relative to the prices of other metals, copper futures rose to $4,394. Platinum futures rose to $1027.40 an ounce. Palladium futures rose to $2659.00 an ounce.

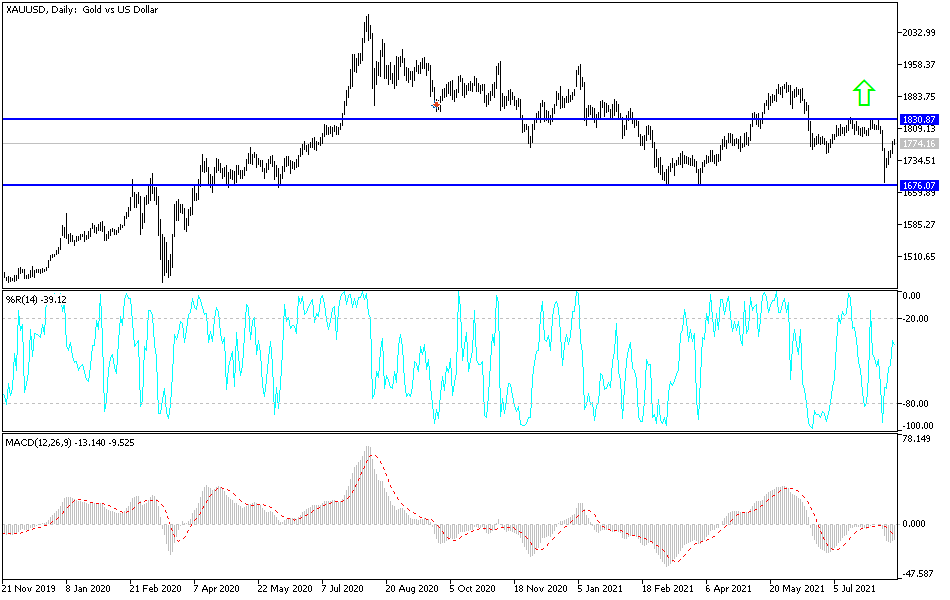

Gold technical analysis

In the near term and according to the performance on the hourly chart, it appears that the price of gold is trading within the formation of a sharp bullish channel. Gold has already risen into overbought areas on the 14-hour RSI, indicating strong short-term bullish momentum in the market sentiment. Therefore, the bulls will look to extend the current gains towards $1,793 or higher to $1,805. On the other hand, the bears will look to pounce on potential pullbacks around $1,766 or lower at $1,754.

In the long term, and according to the performance on the daily chart, it appears that the price of gold is trading within the formation of a descending channel. It has recently bounced back from oversold areas of the 14-day RSI. However, it is still below the 100-day moving average. Therefore, the bulls will look to extend gains with the current bounce by targeting profits at $1,827 or higher at $1,871 an ounce. On the other hand, the bears will target long-term pullbacks at $1,723 and $1,678.