Gold is still trying to remain stable above the resistance of $1700 to avoid more violent bearish pressure, which had plunged the price to $1683 earlier this week. This is in light of sharp gains for the US dollar after the announcement of the US jobs report, which increased expectations of a tightening monetary policy by the Federal Reserve. The dollar's gains coincided with gains for the US Treasury market. Gold prices have fallen by more than 5% over the past week, bringing its decline since the start of the year 2021 to date to nearly 10%.

Sis ilver, the sister commodity to gold, hanging above $23 an ounce. Silver futures rose to $23.525 an ounce. Overall, the price of the white metal fell by 8.3% over the past week, increasing its decline in 2021 to 12%.

Last week, it was reported that the US economy created 934,000 new jobs in July, spurring positive investor sentiment. The glowing data is likely to encourage the Fed to start reducing its $120 billion per month purchases of bonds and mortgage-backed securities (MBS) and possibly start preparing for interest rate normalization. This is bullion's bearish momentum as it would reduce inflation expectations. In addition, gold is sensitive to a higher interest environment because it increases the opportunity cost of holding a non-yielding metallic commodity.

Yesterday, St. Louis Federal Reserve Bank President James Bullard said that last Friday's report, which showed healthy gains at 943,000 jobs last month, means the US economy is making enough progress to begin reducing, or curtailing, its $120 billion monthly bond purchases. The purchases, which began last March during the pandemic recession, are intended to lower long-term interest rates and support the economy. "It's not clear to me that we're really doing anything useful here," Bullard said of the bond purchases.

The US Dollar Index (DXY), which measures the performance of the US currency against six major competing currencies, rose to 93.06, and in general, the index rose by 3.5% since the beginning of the year 2021 to date. A strong profit is bad for dollar-priced commodities because it makes them more expensive to buy for foreign investors. The US bond market is reaping gains, with the 10-year bond yield rising 0.022% to 1.339%. One-year yields rose 0.001% to 0.077%, while 30-year yields jumped 0.021% to 1.982%.

In other metals markets, copper futures rose to $4,359 a pound. Platinum futures rose to $985.30 an ounce. Palladium futures rose to $2,659.50 an ounce.

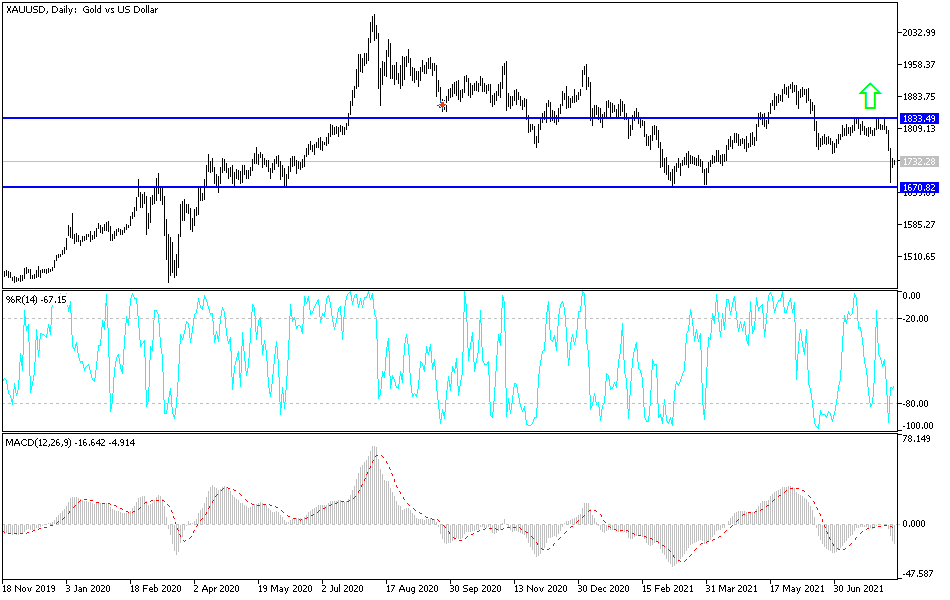

Gold technical analysis

The price of gold is trying to form a new buying base after the recent sharp collapse, and for gold to become bullish again, it would need to breach the psychological resistance of $1800. I still prefer buying gold from every bearish level, the closest of which are currently $1710, $1685 and $1670. To move to the psychological resistance of $1800, the bulls must first move to $1765 dollars per ounce.

The US dollar, and therefore gold, will be affected today by the announcement of US inflation figures. The strength of the numbers is supportive of the dollar and negative for gold, and vice versa. In addition, the price of gold will be affected by the extent of risk appetite.