With the stalling of the US dollar’s gains ahead of the Jackson Hole Symposium this week, gold rebounded higher to $1806, where it has settled as of this writing. This level is the highest for the yellow metal in nearly three weeks. In the first third of August, the price of gold fell to the support level of $1683, and since then it has been attempting to correct upwards. Gold prices are down 4% over the past three months. After yesterday's gains, the yellow metal is retreating from a weekly gain of 1%, to reduce its year-to-date to less than 5%. As for the price of silver, the sister commodity to gold, it also rose at the beginning of the week's trading. Silver futures rose to $23.645 an ounce. The price of the white metal fell by 0.8 percent last week, adding to the 2021 decline of nearly 11 percent.

It was the first time that gold prices settled above the $1800 psychological resistance in two weeks, thanks to the dollar's decline.

The US Dollar Index (DXY), which measures the performance of the US currency against a basket of six major rival currencies, fell to 92.99 from an opening at 93.50. The DXY rose this year by 3.4%, which is a negative factor for the price of gold. A stronger profit is bad for dollar-priced commodities because it makes them more expensive to buy for foreign investors.

This week, the Federal Reserve will hold its summit in Jackson Hole, where Chairman Jerome Powell is likely to ease concerns and refrain from launching the first step in tightening US monetary policy. Last week, policy minutes from the Federal Open Market Committee (FOMC) meeting suggested that officials agreed that now would be a good time to cancel the $120 billion-a- month quantitative easing (QE) program, but that interest rates are likely to remain unchanged until late next year.

Moreover, growing fears of the delta variant continue to plague investors and the global economy, driving traders to traditional safe-haven assets. Commenting on this, analysts at Zaner Metal wrote in a market update, “A significant reversal in the dollar and the widespread risks to the psychology of traders have lifted the price of gold and the rest of the metals among the main reasons for the start of the new trading week. It threatens the global economy, which in turn provides an escape into the interest in buying high-quality gold.”

He added, "At least in the next two sessions, gold and silver trade may avoid the topic of tapering off in the United States until the Jackson Hole symposium begins."

The US Treasury market was mixed in the beginning of the trading week, as the 10-year yield fell 0.005% to 1.255%. One-year yields rose 0.003% to 0.066%, while 30-year yields rose 0.001% to 1.874%. Lower bond yields are bullish for metals because they reduce the opportunity cost of holding non-yielding bullion.

Relative to the prices of other metallic commodities, copper futures jumped to $4.2215 per pound. Platinum futures rose to $1013.20 an ounce. Palladium futures rose to $2395.00 an ounce.

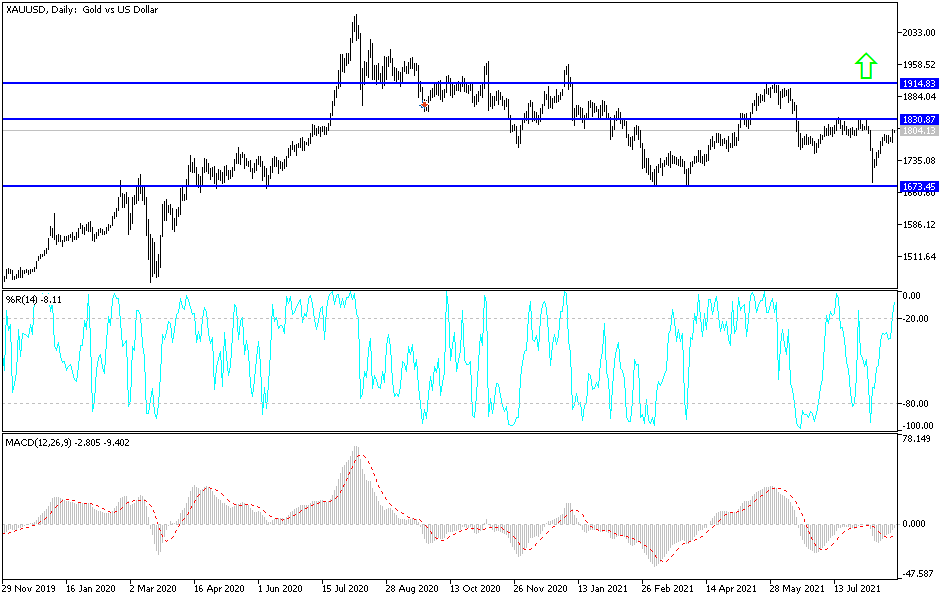

Technical analysis of gold

The stability of the gold price around and above the psychological resistance of $1800 will continue to support the correction upwards because it stimulates buying, and thus a move towards the stronger resistance levels at $1819, $1827 and $1845. This positive outlook for the future of the gold price may be affected if it returns to the support level of $1775 again. I still prefer buying gold from every downside level, taking into account the extreme fluctuation in performance with the start of the Jackson Hole Symposium and what will be said regarding the policy of the Fed.