Friday saw the worst trading session for gold in nearly two months, as the price fell from the $1805 resistance to the $1759 support, before closing at $1764. Gold futures fell on positive US economic data and a stronger US dollar. With the possibility of the US Federal Reserve starting to scale back its very aggressive quantitative easing (QE) program in light of the bullish trends, gold prices reacted negatively and are now trending lower. With the beginning of this week’s trading, the price of gold was exposed to a bearish price gap, as a result of which it rushed towards the $1683 support level, its lowest since March 2021, before settling around the $1746 level again.

In general, the price of gold recorded a weekly decline of 3%, adding to its loss since the beginning of 2021 to date by 7.3%. Over the past 12 months, the price of the yellow metal has fallen by 14%. The price of silver, the sister commodity to gold, also fell below $25 an ounce. Silver futures fell to $24.34 an ounce. Accordingly, the white metal fell by nearly 5% during the week, bringing its loss since the start of 2021 to about 8.25%.

On the economic side, according to the Bureau of Labor Statistics (BLS), the US economy added 943,000 new jobs in July, beating market expectations of 870,000 jobs. The country's unemployment rate fell sharply to 5.4%, better than the average estimate of 5.7%. In June, the US economy created 938,000 jobs with an unemployment rate of 5.9%. The average hourly wage rose 0.4%, the average weekly hours stabilized at 34.8, and the labor force participation rate rose to 61.7%. Almost all sectors recorded job growth, led by leisure and hospitality (380,000), government (240,000), and professional and business services (60,000). Retail lost 5,500 jobs.

Despite concerns about the Delta coronavirus variant, the world's largest economy appears to be on track to recover from the effects of the pandemic. This could prompt the Federal Reserve to start thinking about reducing its $120 billion per month stimulus and relief efforts and start planning to raise US interest rates. If so, it would be less pressure on inflation, which is something gold is usually used as a hedge against.

After the data, the US Dollar Index (DXY), which measures the performance of the US currency against a basket of six major competing currencies, rose to 92.79, and ended the week's trading with a rise of 0.7% over the week and more than 3.1% over the year. A strong profit is bad for dollar-priced commodities because it makes them more expensive to buy for foreign investors.

The US Treasury market was mostly in the green, with the benchmark 10-year yield rising 0.082% to 1.299%. One-year bond yields rose 0.003% to 0.074%, while 30-year yields rose 0.084% to 1.946%. Higher bond yields are bearish for non-yielding bullion because it increases the opportunity cost of owning the metal.

In other metals markets, copper futures were down to $4,336 a pound. Platinum futures fell 3.11%, to $974.40 an ounce. Palladium futures fell to $2,628.50 an ounce.

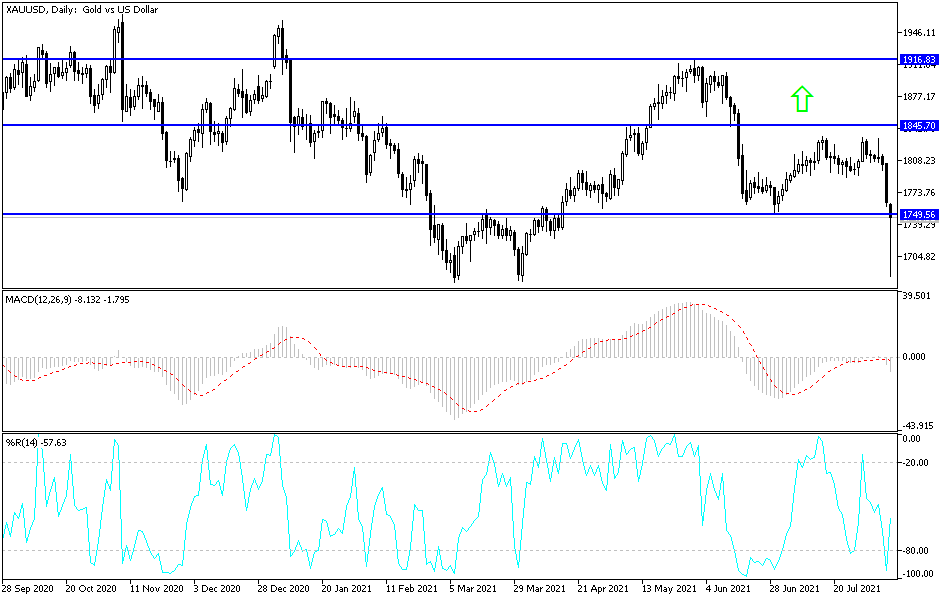

Technical analysis of gold

The stability of the gold price below the $1775 support level will push towards lower support levels, from which we would buy gold and wait for a possible rebound. Currently, the closest support levels are $1735, $1715 and $1680, which are currently the best buying levels. On the upside, as I also mentioned, stability above the $1800 resistance will restore the bulls' dominance and support buying after that to launch higher.

The price of gold will be affected today by the level of the US dollar after the recent data, especially for US jobs, as well as the extent of investor risk appetite.