This is within the weakness of the US dollar after the announcement of the monetary policy decisions of the US Federal Reserve. The selling operations pushed the price of gold towards the support level of $ 1806 an ounce. Gold prices fell at the beginning of this week's trading, as the improvement in risk appetite for high-risk assets encouraged investors to exit from the so-called safe haven assets such as gold.

Stock markets rose across Asia and Europe although the latest batch of manufacturing reports from the region proved to be with mixed results. US stock futures were trading higher in early trading before entering the market as optimism over earnings and some concerns over regulatory crackdown in China eased. Risk appetite was also boosted after the US Senate on Sunday finished finalizing the text of a trillion-dollar bipartisan infrastructure bill. The legislation will then be submitted to the Senate.

The US dollar has settled near a one-month low as investors are now looking forward to the release of the key US employment report later in the week to gauge the health of the labor market for the world's largest economy. For his part, Federal Reserve Chairman Jerome Powell said last week that raising interest rates is "a long way off" and that the labor market still has "some ground to cover."

In the event of a stronger-than-expected July non-farm payrolls report in the US, investors could take the view that the US Federal Reserve will have to scale back its stimulus measures sooner than expected.

Ahead of this week's trading, factory activity in China in July was reported at the slowest pace in 17 months amid rising raw material costs and severe weather, heightening concerns about a slowdown in the world's second largest economy. Regarding the Corona virus, the chief infectious disease expert in the United States, Anthony Fauci, warned on Sunday that “things will get worse” as cases of the virus rise, most of them among the unvaccinated.

Asia has seen a jump in Covid-19 cases, mostly driven by the highly contagious Corona delta variant.

Physical demand for gold was weak in India last week as higher prices dampened retail purchases, while major consumer in China saw some safe buying, although jewelry sales were lackluster.

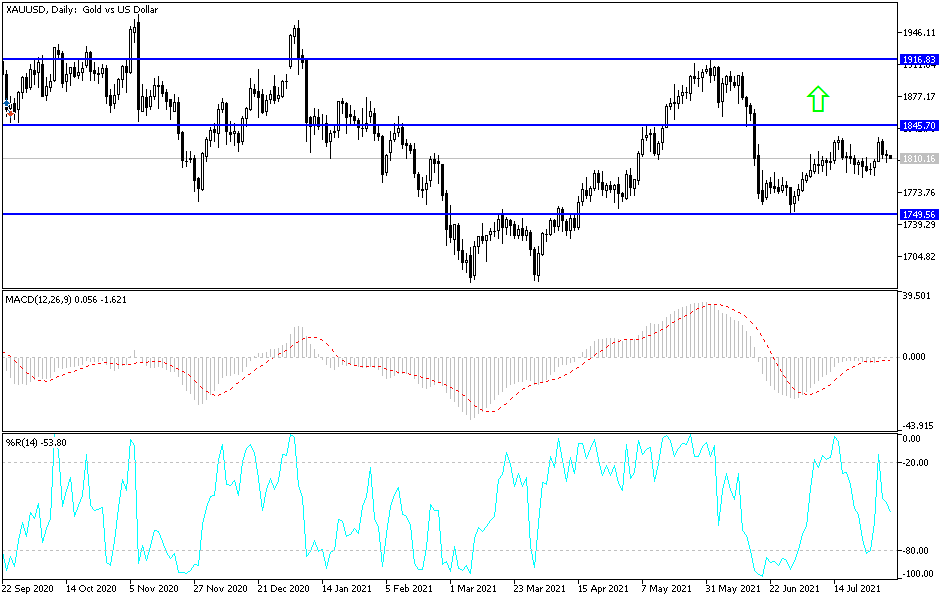

According to gold technical analysis: Despite the decline in the price of gold in the recent trading sessions, the price of gold still has the opportunity to rise as long as it is stable above the psychological resistance of 1800 dollars an ounce. As I mentioned before, the resistance levels of 1819, 1827 and 1845 dollars, respectively, will remain the most important for the bulls to control the general trend. On the downside, breaking below the $1,775 support level for an ounce will end the current bullish expectations, and thus push the gold price to new levels for buying. The price of gold today will be affected by the level of the US dollar and the extent to which investors take risks or not, in addition to interacting with reports of new infections with the Corona virus.