From there we launched a sell recommendation with the goal of a safe exit to the level of 1800 dollars per ounce. The price of gold returned to a rapid decline due to the recovery of the US dollar during yesterday's trading session. Currently the price of gold is stabilizing around the level of 1808 dollars per ounce. It may interact today with the monetary policy decisions of the Bank of England, and then to the most important event for the markets tomorrow, which is the announcement of the US jobs numbers.

Yesterday the yellow metal benefited from its safe-haven appeal after payroll processor ADP released a report showing US private sector employment increased by much less than expected in July. The ADP said that employment in the private sector rose by 330,000 jobs in July after rising by 680,000 downwardly revised jobs in June. Economists had expected the private sector employment rate to rise by 695,000 jobs compared to the jump of 692,000 jobs originally reported for the previous month.

Buying interest waned over the course of yesterday's trading, as a separate report from the Institute of Supply Management showed that growth in service sector activity in the US accelerated much more than expected in July. The ISM said that its services PMI jumped to an all-time high of 64.1 in July after slipping to 60.1 in June, and any reading of the index above the 50 level indicates growth in the sector. Economists had expected the index to come in at 60.4.

The gold market was dealt another blow after Federal Reserve Vice Chairman Richard Clarida said he supports raising interest rates in 2023. “The conditions necessary to raise the target range of the fed funds rate will be met by the end of 2022,” Clarida stated. This is part of an online discussion hosted by the Peterson Institute for International Economics. Commenting on the performance of the price of gold. Analysts at Commerzbank said they are neutral on gold in the near term but remain bullish on the long term. They added that the inability of gold to maintain its gains is worrisome.

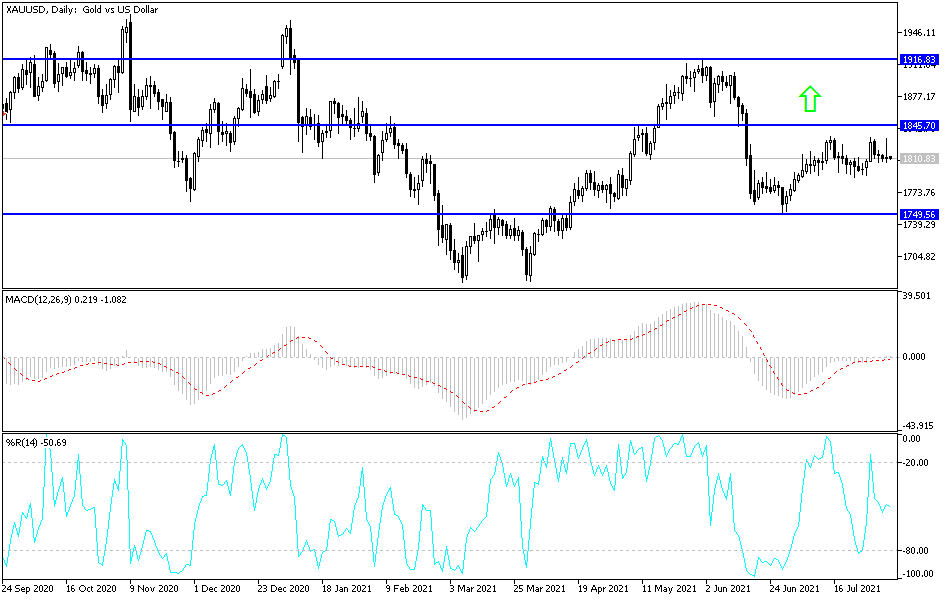

According to gold technical analysis: Despite the recent performance, the price of gold has an opportunity to rise as long as it is stable around and above the psychological resistance of 1800 dollars an ounce. There will be no real control of the bears' performance without moving towards the support levels of 1775 and 1760 dollars, respectively. I still prefer buying gold from every bearish level. The strains of the Corona virus may restore the restrictions of the closure, which is a threat to the future of the global economic recovery and postpones the plans of global central banks to tighten monetary policy, which is the ideal environment for the gold market to achieve strong upward penetrations.

The closest resistance targets for gold are currently 1819, 1827 and 1845 dollars, respectively. The price of gold will be affected today by the level of the US dollar and the extent to which investors take risks or not, as well as the reaction from the monetary policy decisions of the Bank of England.