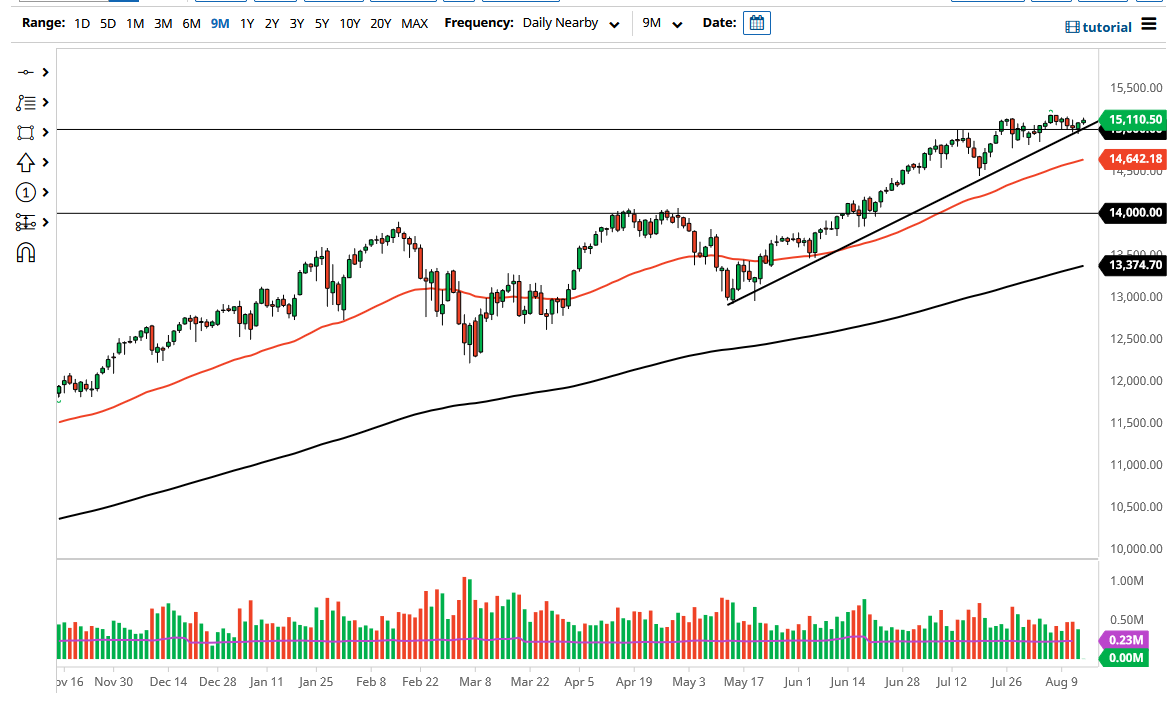

The NASDAQ 100 rallied on Friday again as we continue to see the market go higher, walking along a significant uptrend line that we have been paying attention to for several months now. With this being the case, it looks like we are prepared to go higher given enough time, and I think it is only a matter of time before the buyers come in and overtake the market to reach towards all-time highs. After all, the S&P 500 and the Dow Jones Industrial Average both have already hit all-time highs. I suspect that it is only a matter of time before the NASDAQ will do the same.

The 15,000 level obviously will attract a certain amount of attention as well, and the fact that the uptrend line coincides with it makes sense. If we can break out to an all-time high, then it is likely that we could go looking towards the 15,500 level. The market does tend to move in 500-point increments, so that makes sense. However, even if we were to break down below the uptrend line to the 15,000 level, I think it is only a matter of time before the buyers would come back and pick the market back up. The 50-day EMA sits at the 14,600 level and is rising. With that in mind, I think there is dynamic support right at that indicator. If we were to break down below there, then it is likely that the market goes looking towards the 200-day EMA next. Regardless, I have no interest in trying to short this market, as we have seen buyers jump in every time there is a significant pullback.

Keep an eye on the interest rates in the United States because they can move this market quite drastically. If interest rates spike suddenly, that could work against this index, so that is one thing that you will have to pay attention to more than anything else. Regardless, I have no interest in shorting this market, as it is far too strong and manipulated by the Federal Reserve to get overly aggressive to the downside.