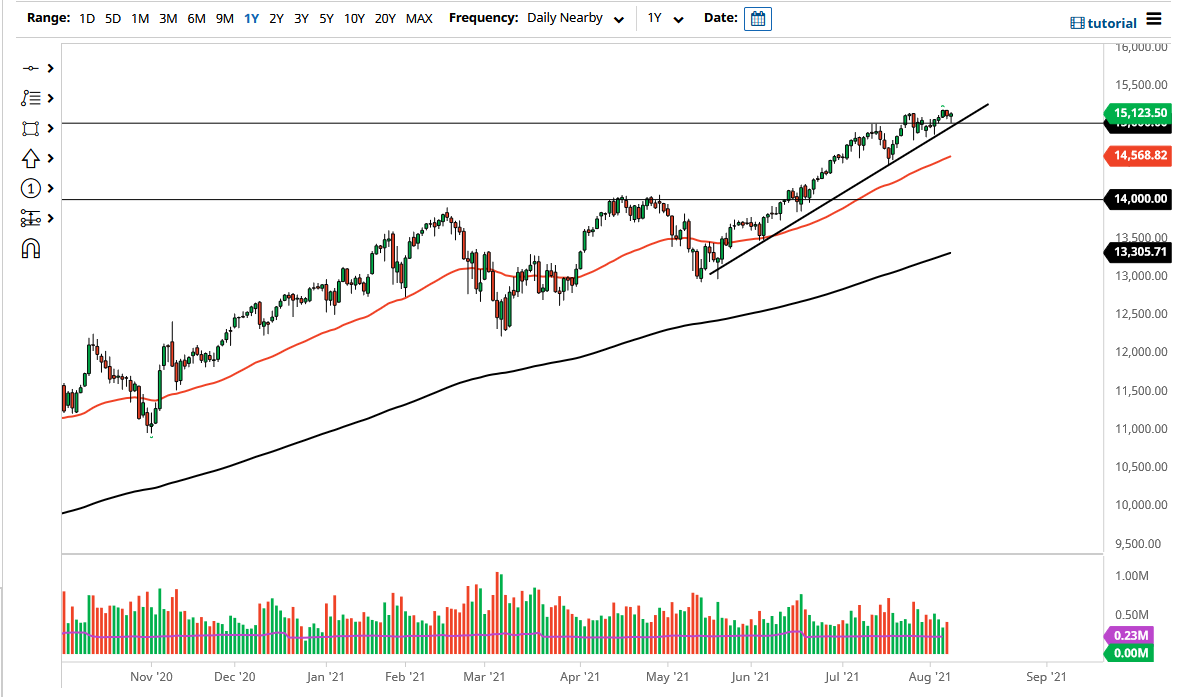

The NASDAQ 100 fell a bit during the trading session on Monday to crash into the 15,000 level. The 15,000 level has a certain amount of psychology attached to it and is previous resistance. The fact that we have pulled back to that level and balanced is a good sign and suggests that perhaps the NASDAQ 100 is going to continue to hang about in a significant uptrend like we have for quite some time.

The uptrend line underneath is crucial, and so far, it has been respected. The NASDAQ 100 has continued to move back and forth with the idea of interest rates, so you should pay close attention to whether they are rising or falling. When interest rates fall, that does tend to help the NASDAQ 100, although that correlation can break down at times. (During the session we had seen rates rise slightly while the NASDAQ 100 held firm.) That being said, the correlation seems to stick together over the longer term, so must pay close attention to the 10-year note to get an idea as to where we may go next.

If we do break down below this uptrend line, the 50-day EMA currently sits near the 14,600 level and should offer plenty of support underneath. That area I believe will be one of the first major areas of buying pressure, assuming we even fall that far. On the other, if we turn around and break above the recent highs, then it is likely that the NASDAQ 100 will go looking towards the 15,500 level, which coincides quite nicely with the fact that the market tends to move in 500-point increments.

I do not have any interest in trying to short the market, at least not in the traditional sense. I might be a buyer of puts, because at least then I can protect my downside. If you get involved in these markets and start shorting, it only takes a few choice words to get everything turning right back around and rally them. Keep in mind that we have CPI figures later this week that could come into the picture and play havoc with rates, so keep that in mind as well.