The NASDAQ 100 rallied significantly on Monday as we continue to see plenty of momentum jump to the upside ahead of the Jackson Hole meeting. This is typically the time year when we start to get an idea of what central banks around the world will start putting into place over the next several months. After all, there are a lot of concerns when it comes to the global reflation trade and the strength of the global economy.

The size of the candlestick is very strong, as we are closing towards the top of the range. This typically means that we are going to continue going higher as well, and as we head towards the Jackson Hole Symposium statement. That will continue to take the stage front and center, as we see that the idea of the US dollar and interest rates moving will have a major influence on the markets. This be especially true as the interest rates have such a major influence on this market. If the Federal Reserve does in fact start to taper, that will send a lot of negativity into the NASDAQ 100, which typically does better with lower interest rates.

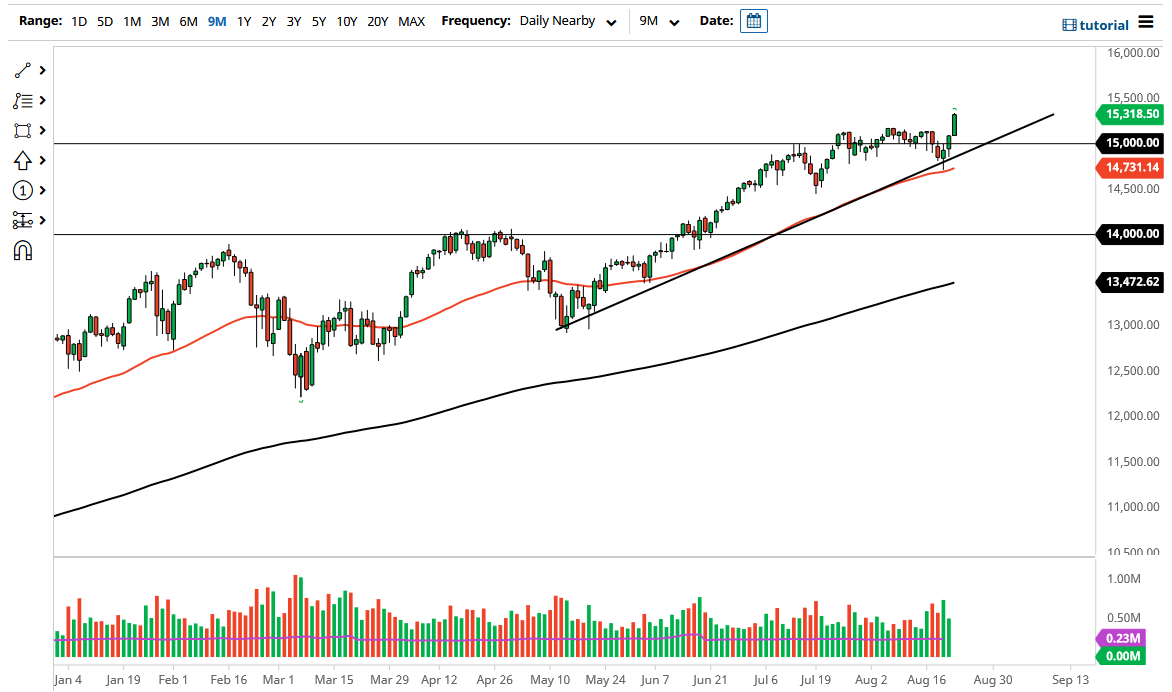

Nonetheless, the market has clearly spoken, and they believe that we are going to continue to see plenty of bond buying by the Federal Reserve, driving down those yields. If that is going to be the case, then the NASDAQ 100 will continue to be very bullish. From a technical analysis standpoint, the 15,000 level underneath is a large, round, psychologically significant figure, and we have the uptrend line as well as the 50-day EMA reaching towards that area. The market is more likely to see 15,500 then it is 15,000, but one would have to see the 15,000 level as a potential area where the “value hunters” come into the picture.

If we did break down below the 50-day EMA, then I might be a buyer of puts, especially if it is after Jerome Powell says something about tapering between now and the end of the year, because it would obviously be very bearish for the market. Nonetheless, I will not step into the market and short right away nor will I short nakedly, because it is a great way to lose money.