The NASDAQ 100 pulled back a bit during the trading session on Friday as the interest rates in the United States spiked. Interest rates going higher quite often will work against the value of the NASDAQ 100, as a lot of the largest growth stocks in the world push it along. Growth stocks are typically bought once interest rates are strong, because there is no yield to be had anywhere. On the other hand, if those yields start to pick up, then a lot of traders will sell these growth stocks because you can earn a return from simply holding onto bonds.

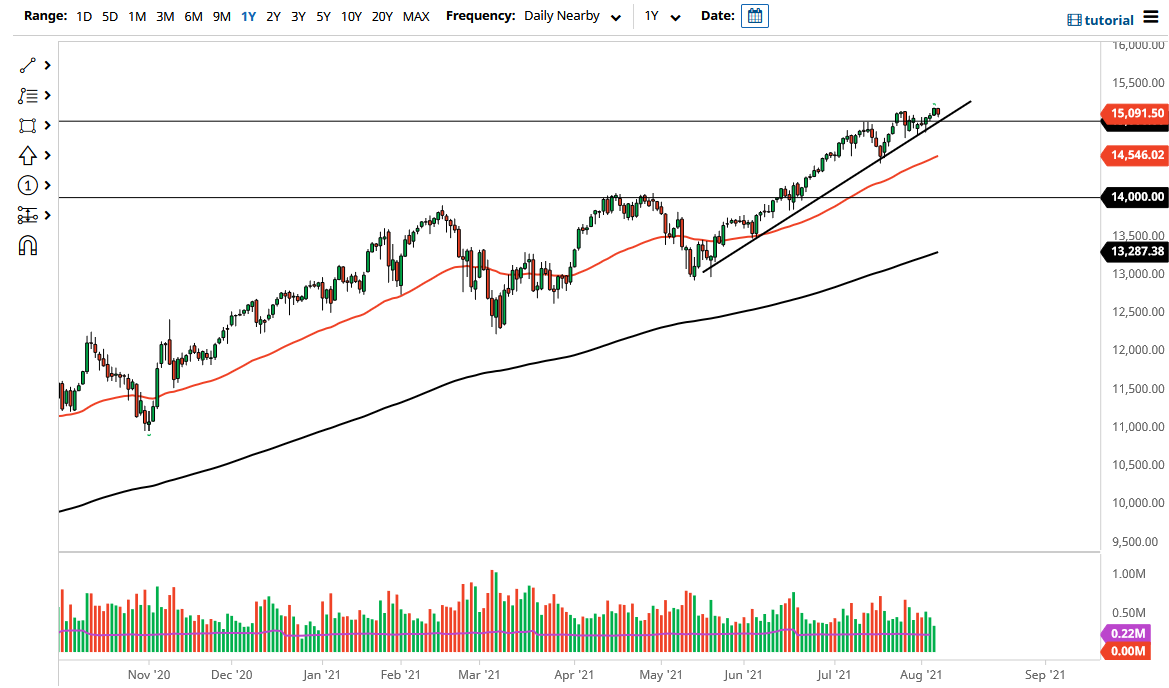

Looking at this chart, it is obvious that the 15,000 level underneath coinciding with the uptrend line should offer plenty of support, so I am not overly concerned about this index, but I do recognize that it has been noisy as of late and it is likely that we will see a bit of a tug-of-war appear. That being said, if we were to break down below the 15,000 level, then I think it is possible we could go looking to the 14,500 level underneath, which is where the 50-day EMA currently sits. After that, we could see a move down to the 14,000 level which I believe is the “floor in the market” currently. Nonetheless, keep in mind that it is only a handful of stocks that push this thing around, so all of the “Wall Street darlings” need to be paid close attention to such as Amazon, Facebook and Alphabet.

We are in an uptrend, so we should ignore any idea of selling, unless we break down below the 14,000 level, at which point I might be a buyer of puts; but as we know, Uncle Jerome will do whatever he can to keep the stock markets going higher. With that being the case, it remains a “buy on the dips” type of scenario and I just do not see that changing anytime soon, especially as long as the Federal Reserve continues to make loose monetary policy its number one job. To the upside, believe that the 15,500 level will be targeted, and then eventually the 16,000 level after that. This market does tend to move in 500-point increments, so none of that should be a huge surprise.