The NASDAQ 100 is stalling as we head towards the Jackson Hole Symposium, which will feature several central bank statements giving us an idea as to what traders can expect out of central planners. The only question at this point is whether or not the Federal Reserve is going to taper bond purchases, which it has suggested could be possible between now and the end of the year. Anybody who has traded for more than five minutes knows that the Federal Reserve is stuck, and they are not going to be tapering anytime soon. In fact, if they were serious about it, tapering would probably completely wreck the market.

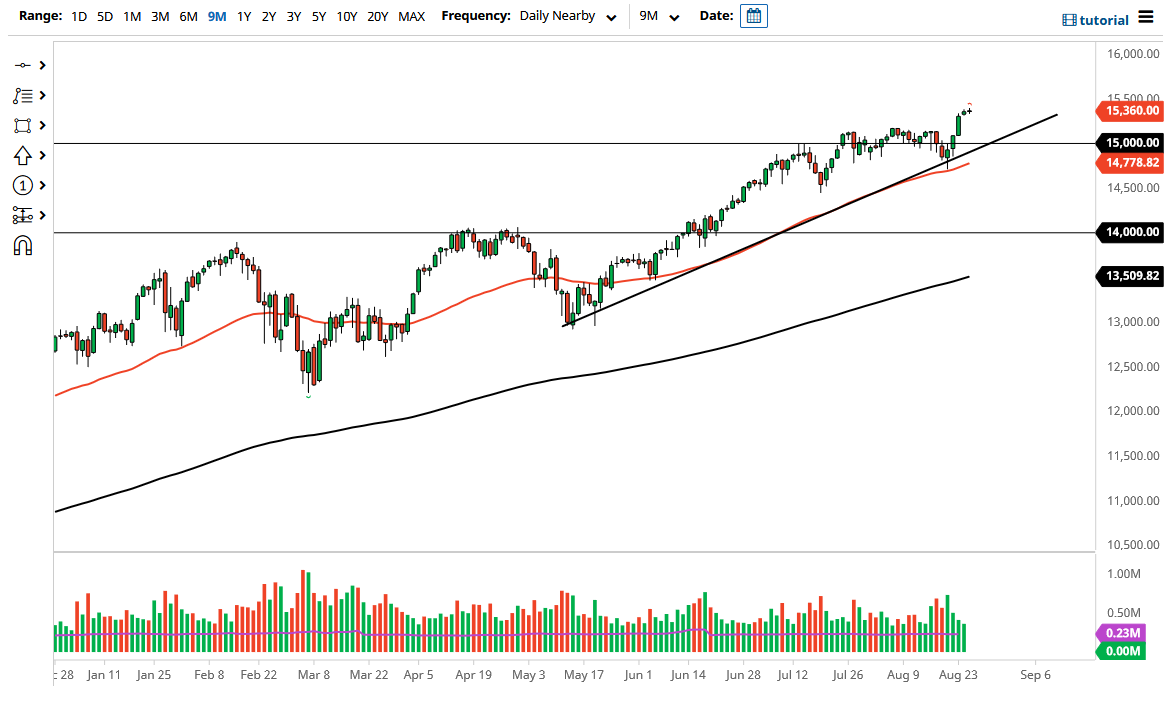

I do think that pullbacks are very likely, but the 15,000 level should be a significant support level, based not only upon the large, round, psychologically significant figure, but also the fact that there is an uptrend there and a 50-day EMA sitting just below. This is a market that I think will continue to find plenty of buyers if interest rates stay low - and they will, as “growth stocks” tend to do fairly well in that scenario. That being said, we are pausing a bit as we head into the Jackson Hole meeting, which makes sense considering we had shot straight up in the air during most of the week.

If we do break down below the 50-day EMA, I might be able to start buying puts, but I do not think that we are going to see any significant opportunity to short this market, because as soon as Wall Street throws a tantrum, the Federal Reserve will step out to talk about how they were “just kidding” when it comes to normalizing monetary policy. The growth situation around the world is far too weak to continue going higher, and despite the fact that there are arguments out there for inflation, the reality is that every time the Federal Reserve steps away people start selling everything they can get their hands on. This is the way it has been for 13 years, and I just do not see a scenario in which that will change anytime soon. Markets are weighted to just a handful of stocks, which are all the “Wall Street darlings”, and I think it is only a matter of time before we go towards 15,500 above.