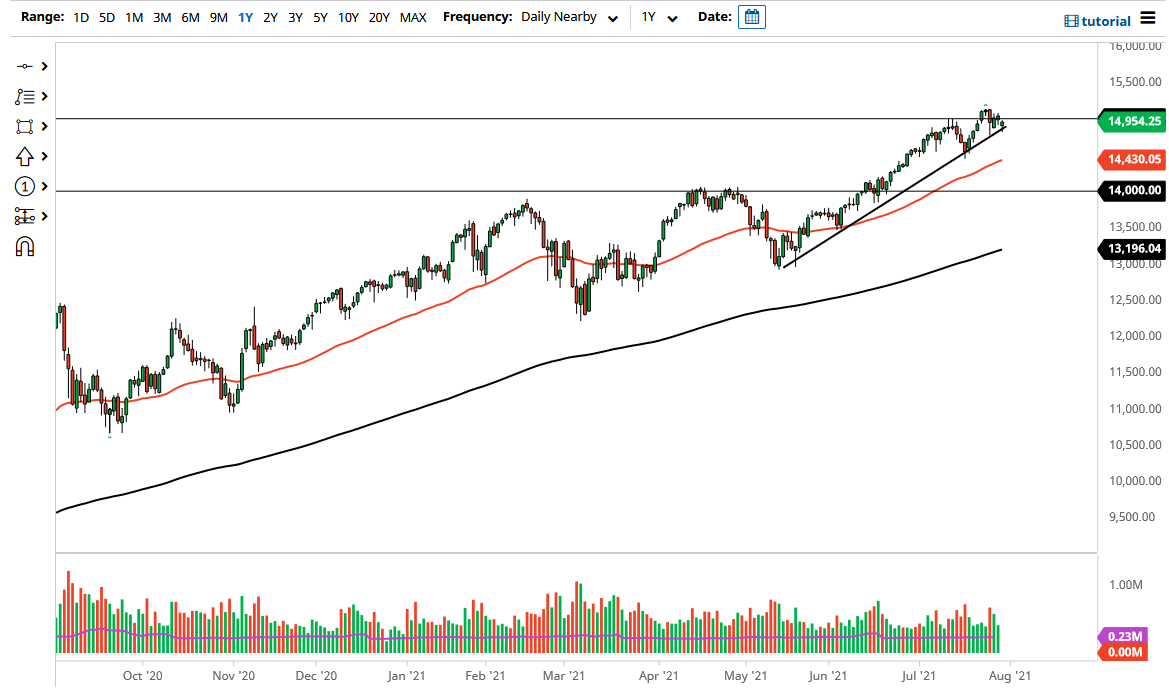

The NASDAQ 100 initially sold off during the trading session on Friday but recovered again at the uptrend line as we continue to see plenty of buyers jump into this market. Ultimately, this is a market that I think will go looking towards the highs again, and perhaps beyond that. The NASDAQ 100 continues to see a lot of momentum based upon low interest rates making growth companies favorable.

A lot of the selloff may have been due to Amazon grinding a little bit lower on Thursday, but that should be expected as the world reopens. Nonetheless, it is more or less a slowdown of growth that Amazon’s talking about, not some type of slack in their business. If that is going to be the case, then it makes sense that value hunters came in and picked it up today, right along with the NASDAQ 100 in general. This is a market that will not only take out the 15,000 level, (perhaps by the end of the session), but also the all-time highs and pick up momentum.

If we were to break down below the uptrend line, I think there are plenty of buyers underneath at the 14,500 level, as well as the 50-day EMA which is sitting at the 14,430 level underneath there. With that being said, the market will continue to be a “buy on the dips” type of situation, and that is how I will trade it. I have no interest whatsoever in shorting the NASDAQ 100 nor do I have any interest in shorting anything remotely close to a US index. Remember, these are all manipulated by the Federal Reserve throwing liquidity into the markets, so it is a fool’s errand to try to find a spot where you can short it. If we break down below the 14,000 level I might be willing to buy puts, but that is as bearish as I get. With all of the liquidity measures still being taken by the Federal Reserve, there are only two possible choices: you are either long of the market or on the sidelines. I think that is going to continue to be the case going forward, just as it has been for the better part of 13 years.