The NASDAQ 100 rallied quite significantly during the trading session again on Friday as Jerome Powell's comments at the Jackson Hole Virtual Symposium have come and gone. He basically said that although there might be a bit of tapering at the end of the year, the reality is that a rate hike anytime soon is a fantasy. Because of this, the market is likely to continue to see further upward pressure as the trend continues to assert itself.

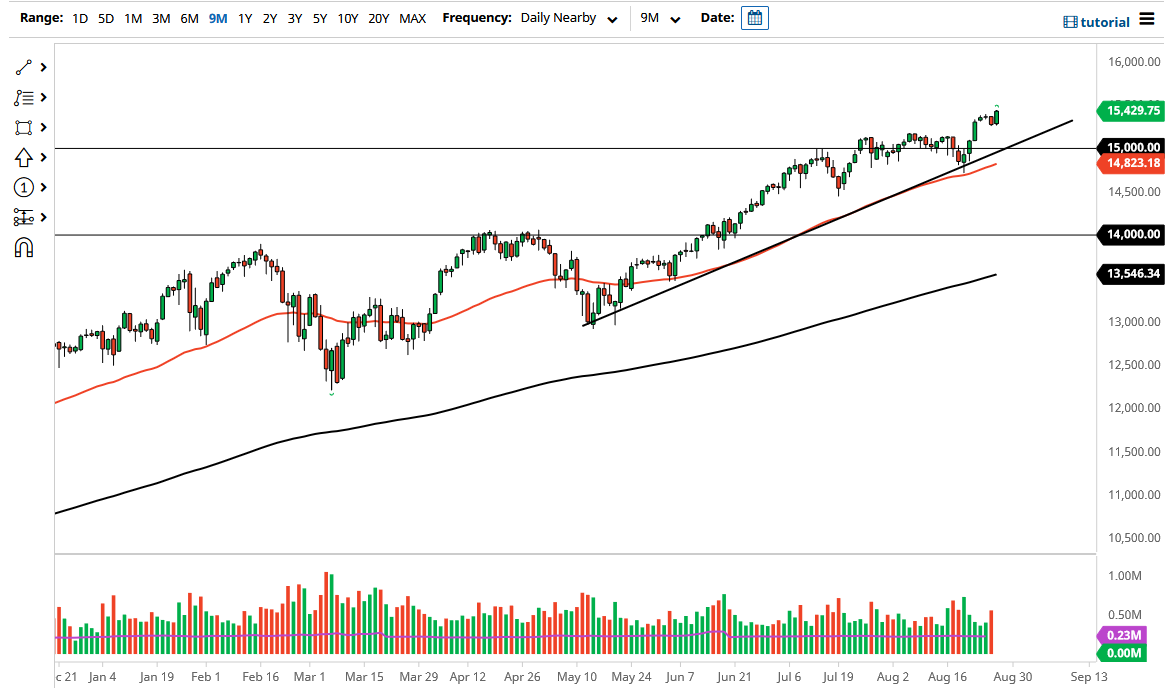

The market should continue to see a lot of support underneath at the 15,000 level, due to the fact that the market tends to be attracted to large figures anyway. Beyond that, we also have the uptrend line crossing through that right now, and the 50-day EMA is starting to reach towards that area as well. This is a market that I think will find plenty of value hunters on any type of significant pullback.

Nonetheless, it is obvious to me that we are going to simply continue to melt higher going forward as the market simply cannot seem to find a reason to break down for more than about five minutes. With this, the market is likely to see the 15,500 level taken out rather quickly, and then a move towards the 16,000 level would have to be the next target. The market has been in an uptrend forever, so obviously you cannot sell it. Pullbacks at this point will end up being buying opportunities, but if we were to turn around and break down below the 50-day EMA, then it is possible that we could see a scenario in which buying puts could make sense, because at least then you will be risking a major amount of money. Furthermore, it keeps you from getting run over by the Federal Reserve saying or doing something to save Wall Street yet again. This is a market that will continue to see plenty of reasons to go higher. At the very least, the fact that tapering is going to be slow and methodical would make the idea of buying growth stocks very attractive to most people, especially as there are only about seven companies that push this market more than anything else.