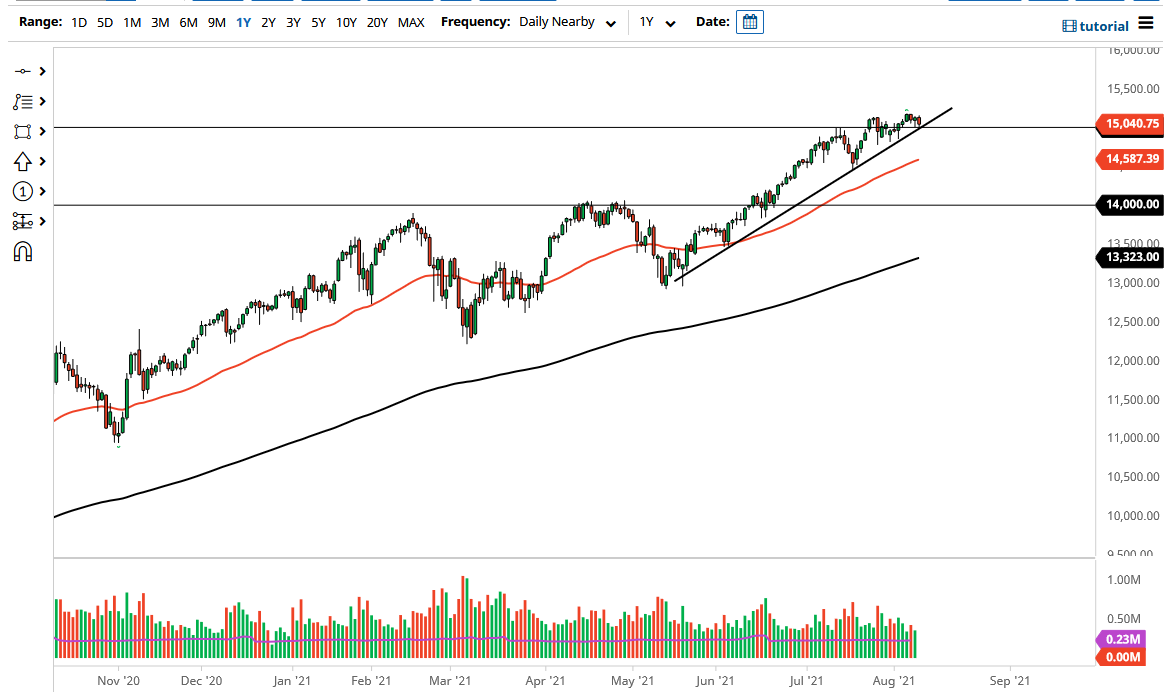

The NASDAQ 100 pulled back a bit during the trading session on Tuesday as we wait for the CPI figures on Wednesday. The market is testing the uptrend line that I have marked on the chart and that the market has been paying close attention to. The 15,000 level is a large, round, psychologically significant figure and an area that would attract a lot of attention as well. The fact that we have broken down during the session on Tuesday probably is not a huge surprise considering that the CPI figures tend to make a huge move one way or the other in interest rates.

The market tested the bottom of the hammer from the Monday session, and did close closer towards it, so I think at this point it is likely that we will see a big move. If we break down below the uptrend line, then it is likely that we could go looking towards the 14,750 level, possibly even the 14,500 area. That is where the 50-day EMA is currently sitting, and I think it would be a nice area of massive support.

If we turn around and break above the top of the candlestick for the trading session on Tuesday and close above there, it is very likely that we will continue to go higher, perhaps reaching towards the 15,500 level. This market does tend to move in 500-point increments, and every time the market pulls back, I start to look towards those levels going forward. That being said, if we were to break down below the 50-day EMA, I might be a buyer of puts, but I would certainly not short this market because the Federal Reserve and everybody else get involved and push these markets higher regardless of what happens.

At this juncture, I do think that we will eventually go higher, but it is going to be a very noisy market to say the least. It does tend to move higher when we get lower interest rates, so the 10-year yield is going to be the most important indicator that you need to pay attention to to remember that correlation; it is a very reliable one as of late.