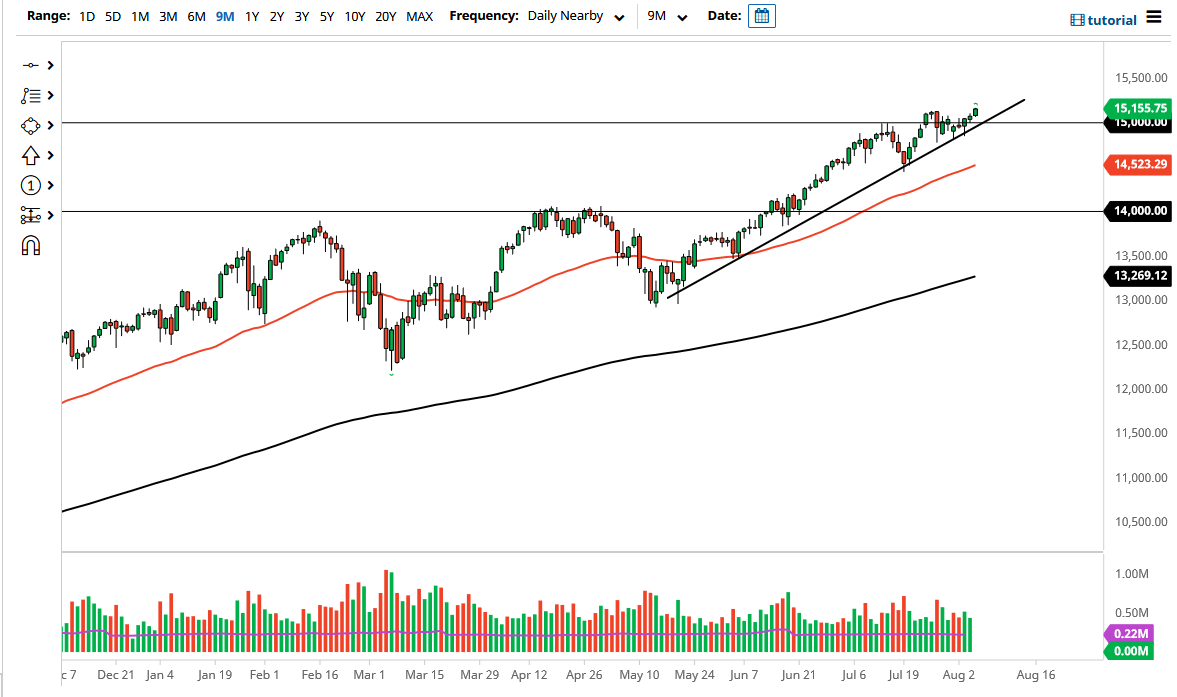

At this point, I believe that the 15,000 level underneath will continue to be significant support, and with that being the case I think that whatever noise we get from the jobs number will be supported in that general vicinity.

Not only do we have the 15,000 level sitting just below, but we also have an uptrend line as well as a hammer that comes into the picture. With that being the case, the market will more than likely find plenty of buyers jumping in, assuming that we even drop. It is very possible that we continue to see plenty of momentum to the upside regardless, as now that we are clearly above the 15,000 level, it is likely that we could go looking towards the 15,500 level. The market does tend to move in 500 point increments regardless, so that is always something to pay close attention to.

If we were to break down below the uptrend line, then it is possible that we could go looking towards the 50 day EMA underneath, which is getting just above the 14,500 level. That is an area that I think would attract a lot of attention, and then below there it is likely that we could go looking towards the 14,000 level where I think the “floor in the market” is certainly going to be a major supportive region. The 14,000 level of course is going to attract a lot of attention, and therefore I think you should pay close attention to any type of reaction to that level, assuming we even get that type of correction.

Pay close attention to the 10 year note, because if yields continue to drop that typically will have money flowing into growth stocks, which of course drive the NASDAQ 100 higher. After all, it is a market that tends to see plenty of reasons to go higher regardless, so really there is no point in fighting this. I am a buyer of dips and nothing more, especially as the Federal Reserve will do nothing to upset the apple cart anytime soon.