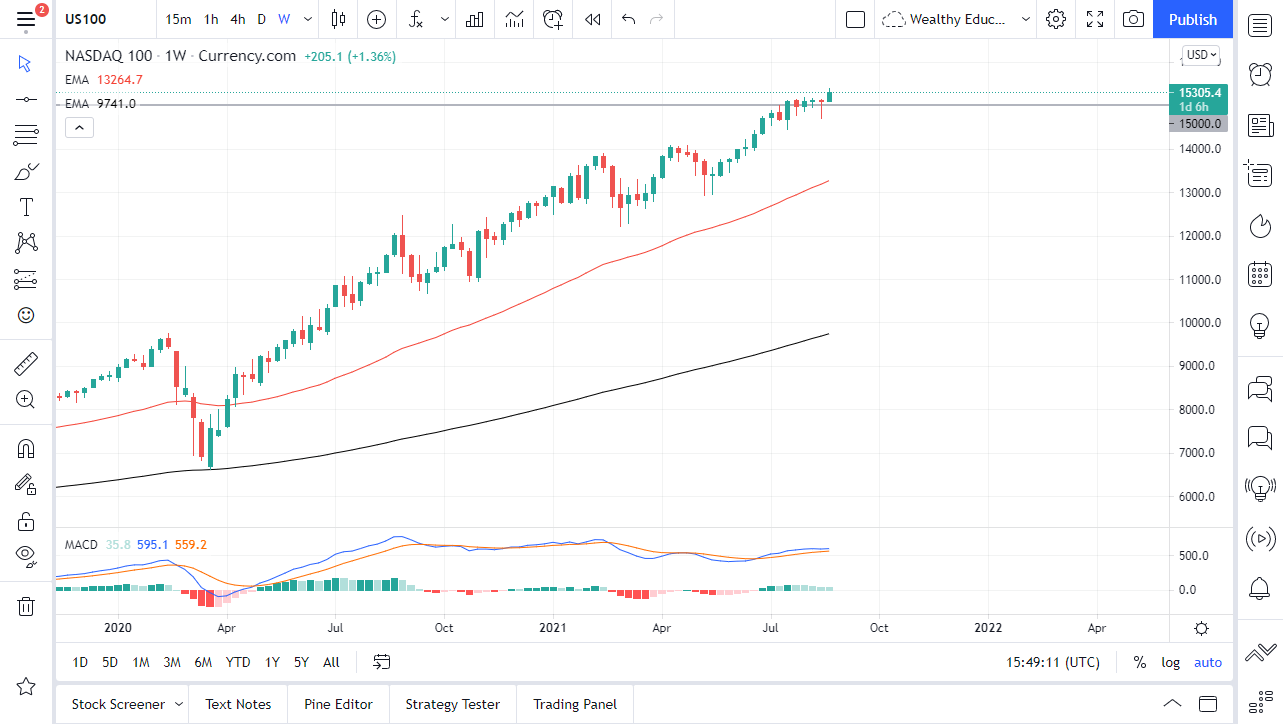

The NASDAQ 100 has been relatively flat most of the month of August, but towards the end we started to see a little bit of a breakout yet again. By doing so, the market looks as if it is ready to go much higher, which would be typical due to the Federal Reserve and its manipulation of interest rates. As long as interest rates remain very low, it is very likely that the so-called “growth stocks” that a lot of Wall Street loves will continue to drive higher. It just so happens that the biggest drivers of the NASDAQ 100 are the same stocks such as Tesla, Amazon, and Alphabet.

The 15,000 level is a large, round, psychologically significant figure and causes quite a few headlines to come across traders' desks. The 15,000 level has been an area that a lot of traders have paid close attention to, and now that we are breaking out it should open up the possibility of another 500 points or so. The 15,500 level is an area that could cause a little bit of headline risk to traders, but we have been in an uptrend for so long that is just what people do.

You can see that the 50-week EMA is all the way down near the 13,100 level and sloping higher. That obviously would attract a lot of attention if we tested that area, and it would be a relatively healthy pullback. One of the big things about the NASDAQ 100 is that the Federal Reserve will continue to get involved, as we have seen the last 13 years be so bullish after the Great Financial Crisis. Ultimately, this continues to be a “buy on the dips” scenario under almost all circumstances, but I might be convinced to start buying puts if we break down below the 14,750 level, as it could be a significant turnaround at least in the short term. Longer term, I believe that this market will more than likely go looking towards the 16,000 level above. Any time we pull back, it is more likely than not that people will be willing to try to take advantage. With that being the case, the market should continue the overall trajectory as it has been rising in a roughly 45° angle.