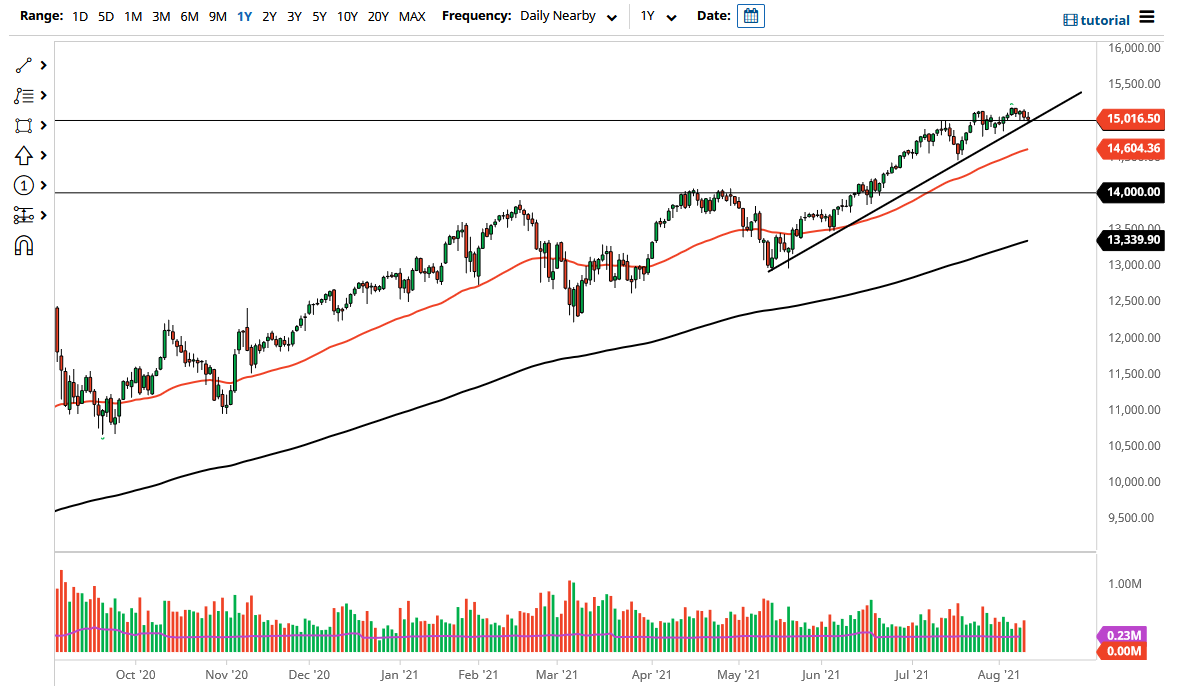

The NASDAQ 100 initially tried to rally on Wednesday but gave back the gains as the market continues to look a bit sloppy. The 15,000 level is an area that offers a certain amount of support, especially as it is such a big figure that will attract a lot of attention. Furthermore, there is an uptrend line that is crossing through the 15,000 level, which I think will offer a certain amount of support in and of itself. That being said, as long as we can stay above this uptrend line, that is a good sign, but even if we do break down it does not necessarily mean that we are going to fall apart.

A breakdown at this point more than likely goes looking towards the 14,750 level, possibly even the 14,600 level where the 50-day EMA currently resides. The 50-day EMA is an indicator that a lot of people pay attention to, as it tends to define the overall longer-term uptrend. This is a market that continues to attract buyers on dips, and even though it does look a little sluggish at the moment, I do believe that eventually the value hunters will come back.

This is true even if we break down below the 50-day EMA because I believe that the 14,000 level will attract quite a bit of support as well, especially with the 200-day EMA starting to reach towards that same general vicinity. I have no interest in shorting this market and at the very most I would be a buyer of puts if we break down. With the Federal Reserve looking to get involved and lift Wall Street any time it looks like it is going to lose serious money, there is no way to short. To the upside, if we break above the 15,200 level, then I believe the NASDAQ 100 will continue to climb and go looking towards the 15,500 region. I think the market will pay close attention to the 15,000 level going forward, and it could offer a “floor in the market” overall. Nonetheless, this is a market that should eventually find its footing, so I am looking for signs of support that I can buy into.