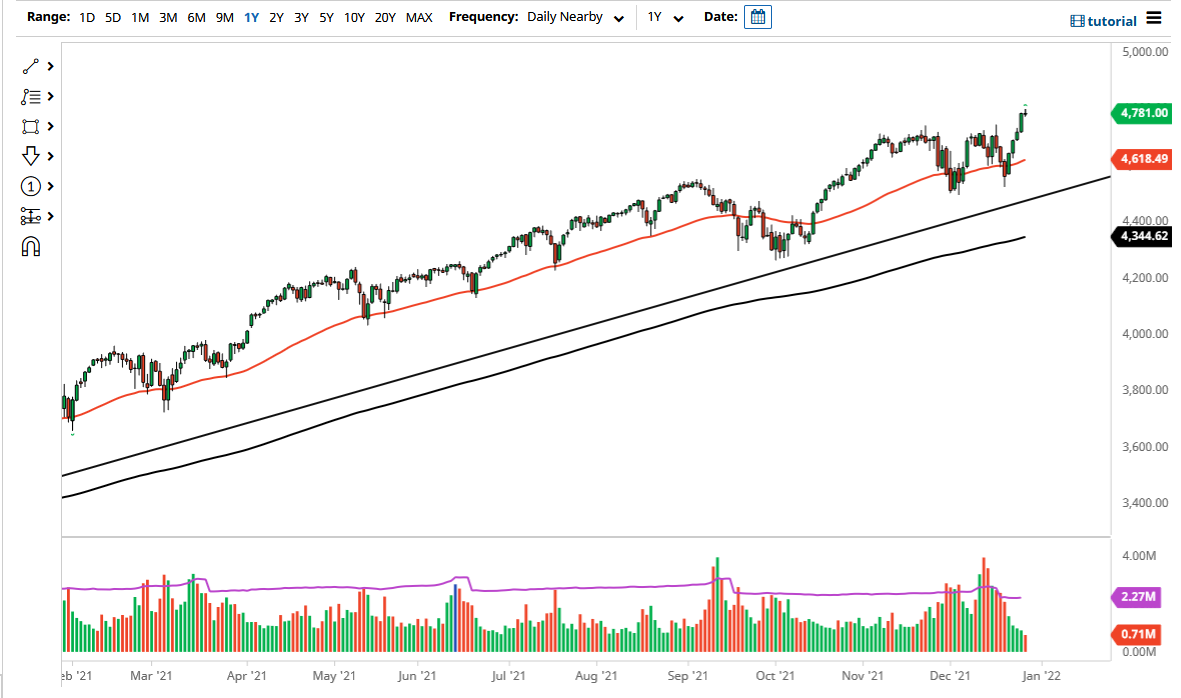

The S&P 500 has rallied a bit during the course of the trading session to break above the 4450 handle, as we are making our way towards the 4500 level. The market has been bullish for some time, and as a result it makes a certain amount of sense that we would see a continuation of this trend going forward. This will be especially true as the market simply looks at every pullback as a potential buying opportunity. Underneath, the 4400 level would be a major support level on shorter-term time frames, but if we were to break down below that level, then I think we go looking towards the 50 day EMA as well as the uptrend line.

If we can break down below the uptrend line, then it is possible that I might be a buyer of puts, as I would anticipate that the next target would be the 4200 level, possibly even followed by the 4000 level which of course is a large, round, psychologically significant figure and an area that would take a lot of effort to break down below. In fact, I believe that the 4000 level will more than likely be the “hard floor in the market” for the uptrend. This is further strengthened by the idea of the 200 day EMA sitting in that same general vicinity.

If we were to rally at this point, I think it is more or less a “buy-and-hold” type of market, but I would not look for bigger moves, simply because we are in the wrong time of the year to think that we would see a lot of volume jump into this market. Furthermore, if we continue to see the Federal Reserve look likely to keep the spigots open, then there is no reason to think that the stock markets will change direction anytime soon, but even if we do pull back a bit, I suspect that the buyers will be waiting to pick up any opportunity that they see. This has been the way the market has behaved for the last 13 years, and I do not see that changing in the next few days. I believe that the 4500 level will cause a little bit of noise, but eventually we will break through that just as we have at other big figures.