The S&P 500 was very noisy during the course of the month on July, and I suspect that August probably will not be any better. Yes, it also will be goosed a bit by the Federal Reserve’s lack of tapering talk, especially after the most recent meeting. However, all eyes will be on Jackson Hole in the month of August, to see what central bankers around the world are thinking. I suspect that there will be a major divergence between some central banks, as the opinions on inflation seem to be all over the board.

We have already seen the Bank of Canada and the Royal Bank of New Zealand taper bond purchases due to the concerns about inflation, but at the same time the Federal Reserve seems to be on the sidelines and willing to flood the markets with liquidity as long as it takes. This is the same playbook for 13 years since the Great Financial Crisis. Because of this, I think it is going to take quite some time for the Federal Reserve to turn the ship around, and at this point I think it is much more likely that they will let the economy run much hotter than people think for much longer.

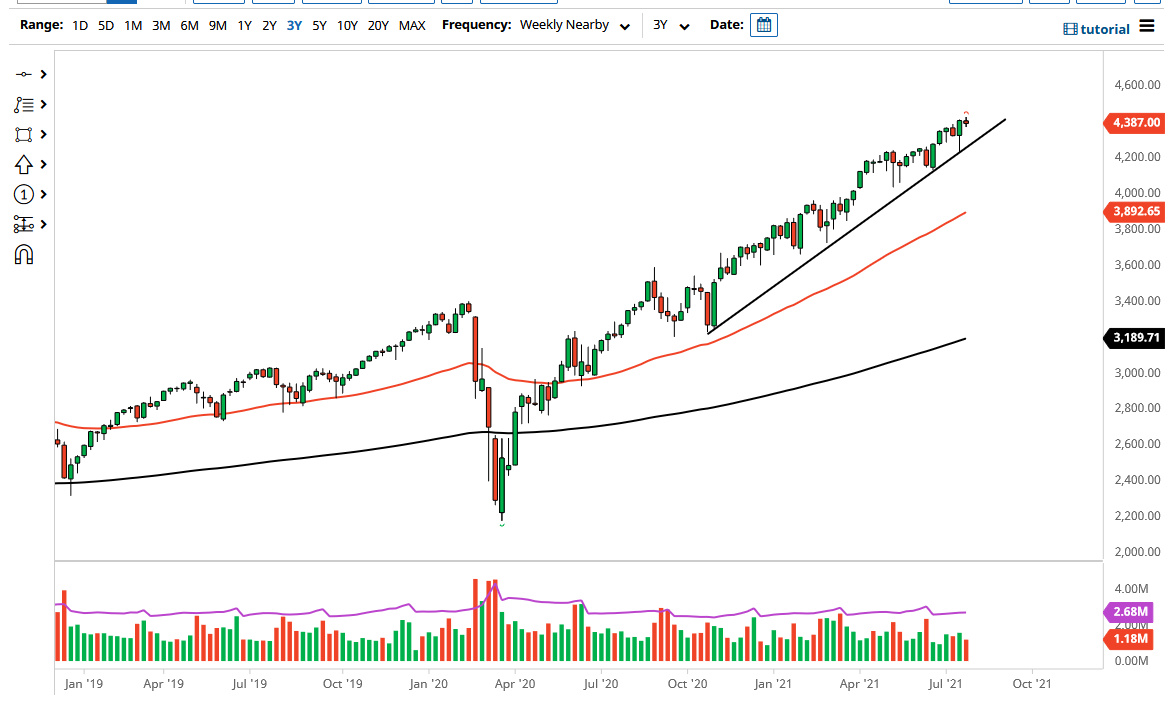

With that in mind, the S&P 500 becomes the same play that it has been over the last 13 years: you simply buy dips as the Federal Reserve will continue to flood the markets with liquidity and, by extension, save Wall Street. This is not to say that we could get a little bit of a pullback, but at this point in time I believe that the absolute “floor in the market” is near the 4000 level, and I do not see the market breaking down below there in the month of August, with perhaps the exception of some type of major unforeseen event.

From current levels, a move towards the 4000 level would be 10%, which typically attracts a lot of buying anyway, as it is considered to be a “standard correction.” I also point out that we have a nice trendline that has been in effect for ages and had seen an attempt to sell off the market late during the month of July, which of course has been turned around quite quickly. I would not be surprised at all to see the markets had 4600 sometime late August.