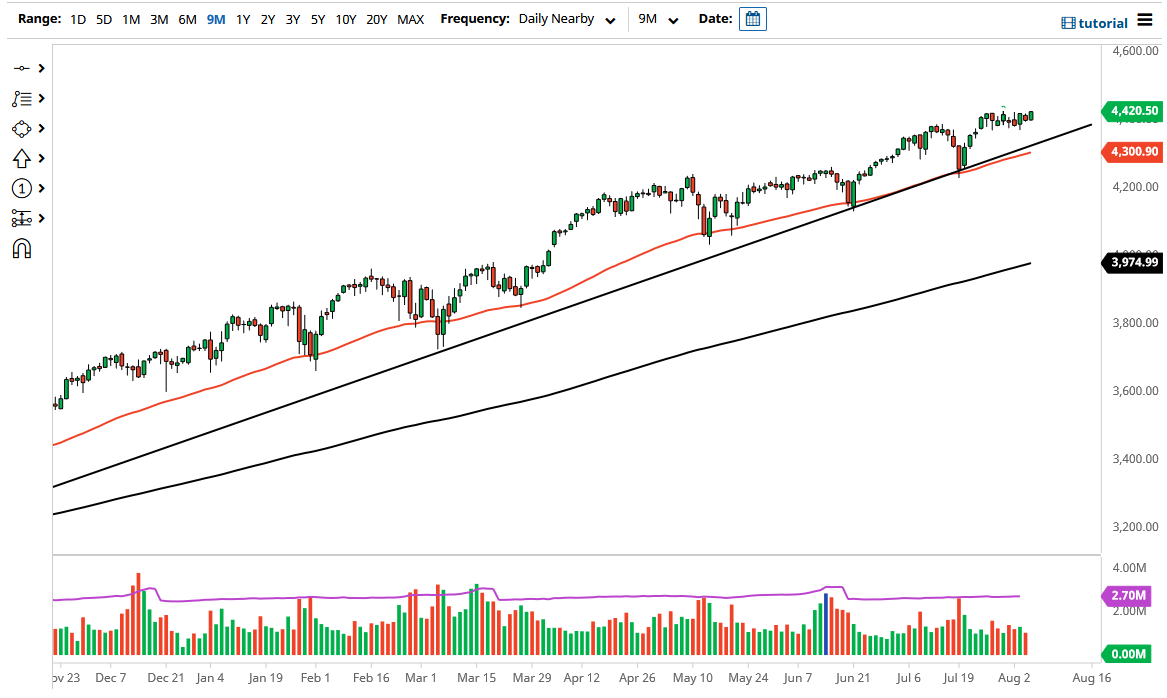

The S&P 500 has rallied to reach towards the 4420 level during the trading session on Thursday, as we are likely to try to break out to the upside. At this point in time, if we do get some type of short-term pullback, it should be a nice buying opportunity, and I think most of the trading community will see it as such. Furthermore, the uptrend line underneath should continue to offer support, right along with the 50 day EMA. The S&P 500 of course is followed by the Federal Reserve, despite the fact that they will not admit it.

All one has to do is look in the past and see how many times they have stepped in to pick the market up, via words or quantitative easing measures. We are almost through earnings season, and have survived quite nicely, so it looks like we are simply going to continue to go higher. I think at this point in time it is probably only a matter of patience before we get to the 4500 level. If we do drop from here, I will be looking to buy the first signs of support, especially if it has something to do with the jobs report.

The jobs report being bad will probably initially have the market selling off, but eventually Wall Street will step in and start thinking about free and easy money, and therefore start buying everything they can get their hands on. That being said, if we did turn around a break down below the uptrend line and the 50 day EMA, then it is possible that we could go looking towards the 4200 level. Furthermore, we could even drop from there and go down to the 4000 handle which I think would be a very interesting place to be, as it is a 10% drop, and of course where the 200 day EMA is starting to set.

If the market were to break down below there, might be a buyer of puts but I certainly would be cautious about selling due to the fact that the Federal Reserve will step in and save the day given enough time. I know they say they will not, but at the end of the day it is a pattern that they are followed for 13 years, and I simply do not see that happening anytime soon.