The S&P 500 rallied again on Wednesday as the market continues to look at the Jackson Hole Summit as a potential event. After all, the world is trying to figure out whether or not the Federal Reserve is going to taper its bond buying purchase program, and that has a major influence on what happens next with the greenback. Nonetheless, at this point, I think it is obvious that the market expects Jerome Powell to walk back some recent bullish statements, in which case it is likely that the market will simply continue to go higher, because that is what has been done for the last 13 years.

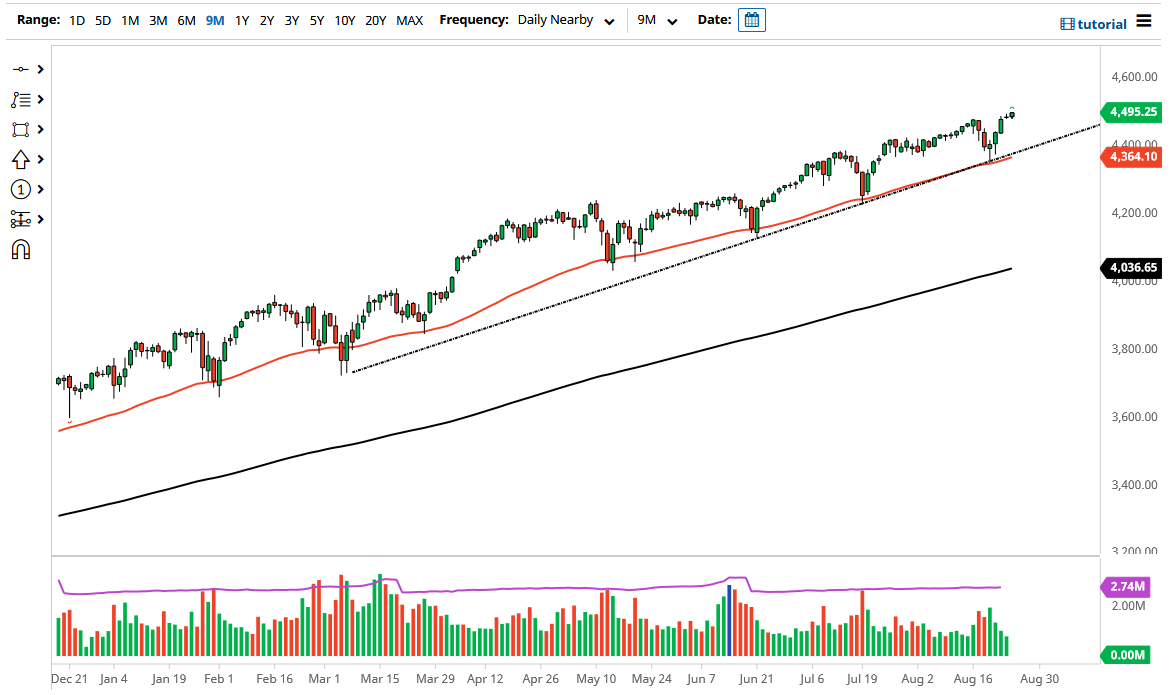

When you look at the chart, we are in a nice uptrend, and that should continue to be the case because Wall Street gets what it wants out of the Federal Reserve, as we have seen over the last 13 years. It is a bit of a cycle, as the Federal Reserve pays lip service to the idea of tapering, and then Wall Street has a little bit of a freak out in order to set them straight again. The Federal Reserve simply cannot taper anytime soon, because at that point you would start to see the national debt become such a major issue.

Do not get me wrong: the United States will never pay back its debt. Because of this, the market is likely to see some type of narrative that sends this market higher given enough time, and even if we do pull back this point it is likely that the 4400 level will come in and support, not only due to the fact that it is a psychologically important figure, but it is also an area where we feature the uptrend line and the 50-day EMA. Buying on the dips has worked for the last 13 years, and there is nothing out there that suggests that this will be any different. However, if we were to break down below the 4300 level, then it is possible that I might be a buyer of puts, but that is probably as bearish as I would ever get at this point. Once we get through Jackson Hole, people will find other reasons to get long. 4500 causes a little bit of a headache, but that will be short-lived.