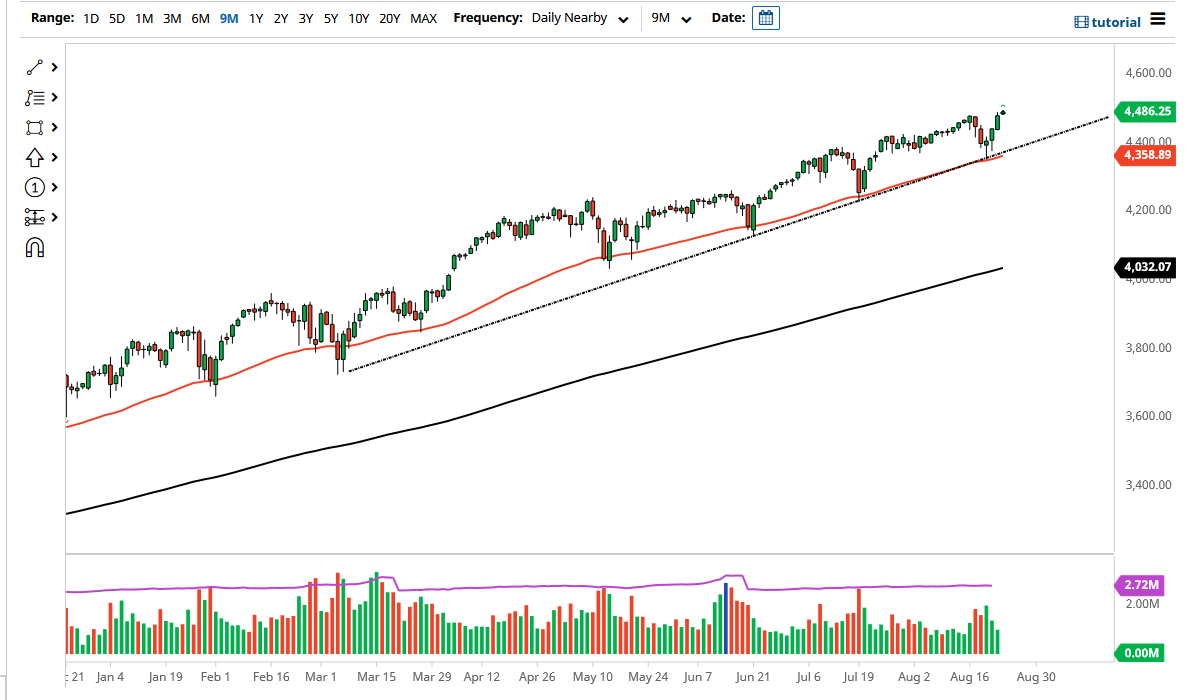

The S&P 500 rallied a bit on Tuesday as it looks like we are hell-bent on trying to break through the 4500 level. The 4500 level would offer a certain amount of headline noise, but it certainly looks as if it is only a matter of time before we break above there. At that point, the market would more than likely go looking to the 4600 level as it tends to move in 200-point increments, so the “rhythm of the market” should dictate that we will looking towards that area.

The market has the uptrend line and the 50-day EMA underneath offering plenty of support, so I think it is going to offer more or less a “floor in the market” going forward, so I would anticipate that any pullback towards that area should offer plenty of buying opportunities. However, if we were to break down below that level, then I think I will be buying puts, as the market is likely to go looking towards the 4200 level, possibly even down towards the 200-day EMA which is sitting just above the 4000 level, an area that I think will offer plenty of interest. In fact, that would be just slightly more than a 10% correction, which is standard fare for uptrends.

The size of the candlestick is not that impressive, so I do think that we are probably going to get a short-term pullback in order to find value hunters underneath. I have no interest whatsoever in trying to short this market like I said, so I think that if you are patient enough you should be able to pick up the S&P 500 “on the cheap”, as it offers plenty of value. To the upside, the 4600 level is the intermediate target, but really at this point the only thing you need to know about the S&P 500 is that the Federal Reserve is more than likely going to jump in and comply with Wall Street’s desires, meaning more cheap money that they can rollover into more profits in the stock market. That is not going to change anytime soon, because every time they have tried to step away from quantitative easing, Wall Street corrects them rather quickly by selling off the markets.