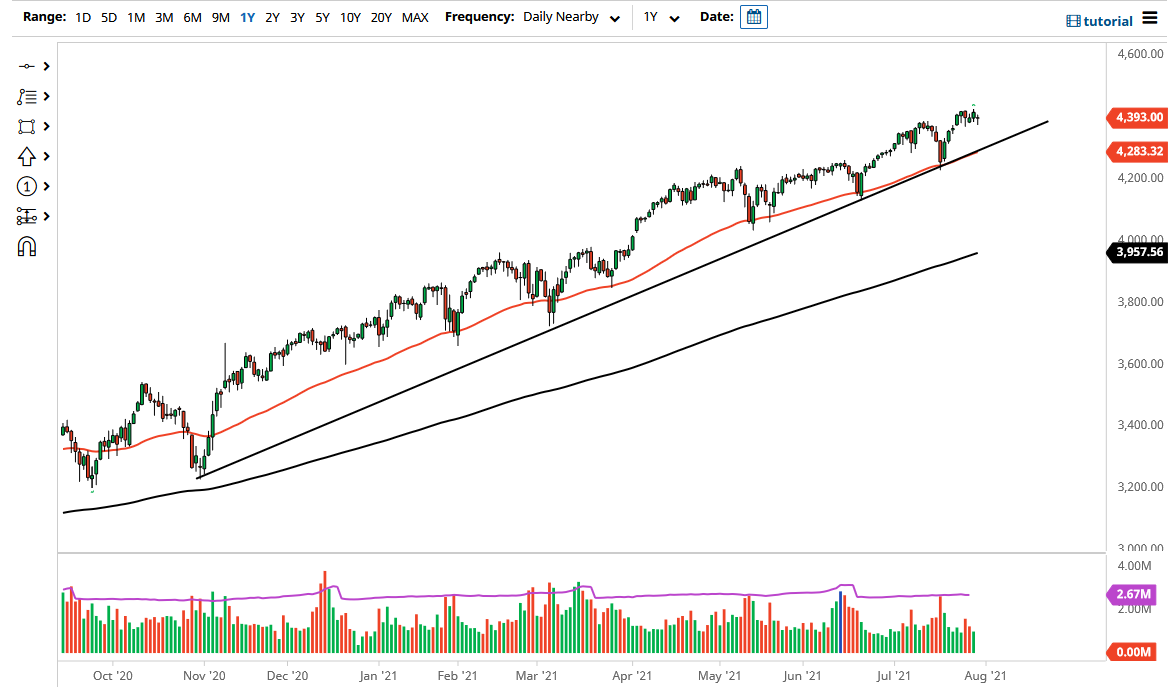

The S&P 500 has been choppy during the trading session on Friday as we try to figure out where to go next. I will give you a hint: it is probably going to be much higher. That being said, the market is more than likely going to continue to find buyers on dips, especially as the uptrend line and the 50-day EMA both come into the picture on a dip. That could send this market much higher based upon the “fear of missing out”, and the fact that anybody who has been concerned about finding value would certainly look at it in that vein.

If we do break down below the uptrend line and the 50-day EMA, then it is likely that we will drop to the 4200 level rather quickly. The 4200 level will offer a certain amount of support, but beyond that we have the 4000 level, which I believe is the “floor in the market”, as not only does the market attract a lot of attention at these big figures, but there will be options barriers and headlines. At that point, it would be a 10% pullback, which is a typical correction in the marketplace to begin with.

If we were to break down below the 4000 level, then it is possible that the S&P 500 would collapse, albeit momentarily, before Jerome Powell comes to save the day. In that scenario I would be a buyer of puts, but beyond that I do not see any opportunity to short this market.

To the upside, if we can break above the 4400 level again on a nice daily close, then I think we would go looking towards the 4400 level next, which is a psychologically important figure, but the market does tend to move in 200-point increments, so my target later this year is 4600. In the meantime, I think it is going to continue to be a significant amount of “choppy and sloppy trading”, so keep that in mind. Keep your position size small and build up as you go forward, allowing for the market to tell you when it is time to get big and allowing you the possibility of taking profits along the way when we get these occasional setbacks. Nonetheless, I think we will go much higher over the longer term.