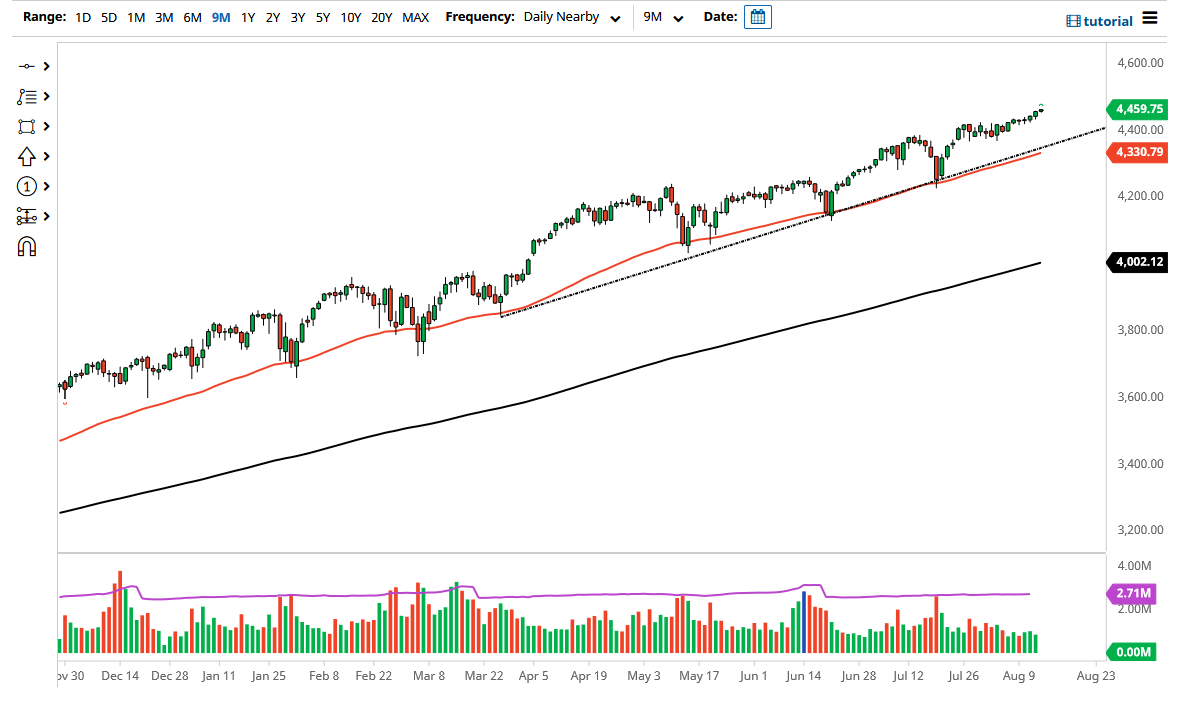

The S&P 500 rallied a bit on Friday as we continue to see liquidity measures prop up Wall Street. We have gotten through the running season, and at this point in time there is no reason to think we will not simply continue to go higher. The 4460 level has offered a bit of short-term resistance on intraday charts, but I do not see anything here that would keep the market from going higher. Furthermore, any pullback will more than likely be bought into, because that is what the S&P 500 does: balance on dips.

The uptrend line and the 50-day EMA underneath will define the trend for most traders, but I do not necessarily think we will get down there. The 4400 level will also offer support, as we had seen it act as a bit of magnet for price recently, so I would anticipate a lot of buying pressure in that area if we do break down to it. The 4500 level above is the target, and I do not see anything on this chart suggesting that we would not have that happen. The 4500 level will cause a little bit of headline noise, but ultimately it will be just another number, as stocks only go higher over the longer term. (Yes, I know that is not necessarily true, but if you look back at the last 13 years, you can make a serious argument for that.)

When you look at the overall attitude of the market, we have followed a nice uptrend for some time, and I think that it is only a matter of time before any dip will be bought for that reason alone. There are some people out there that will have missed out on some of the most recent move, and there will be money managers that have to put money back to work who have collected profits recently. Unless interest rates in America spiked suddenly, there is not much that could cause a lot of damage to this market, and as we are in the quietest time of year, I would anticipate that is especially true right now. The candlestick is not that impressive, but the fact that we simply do not fall for any length of time is probably what is most important here.