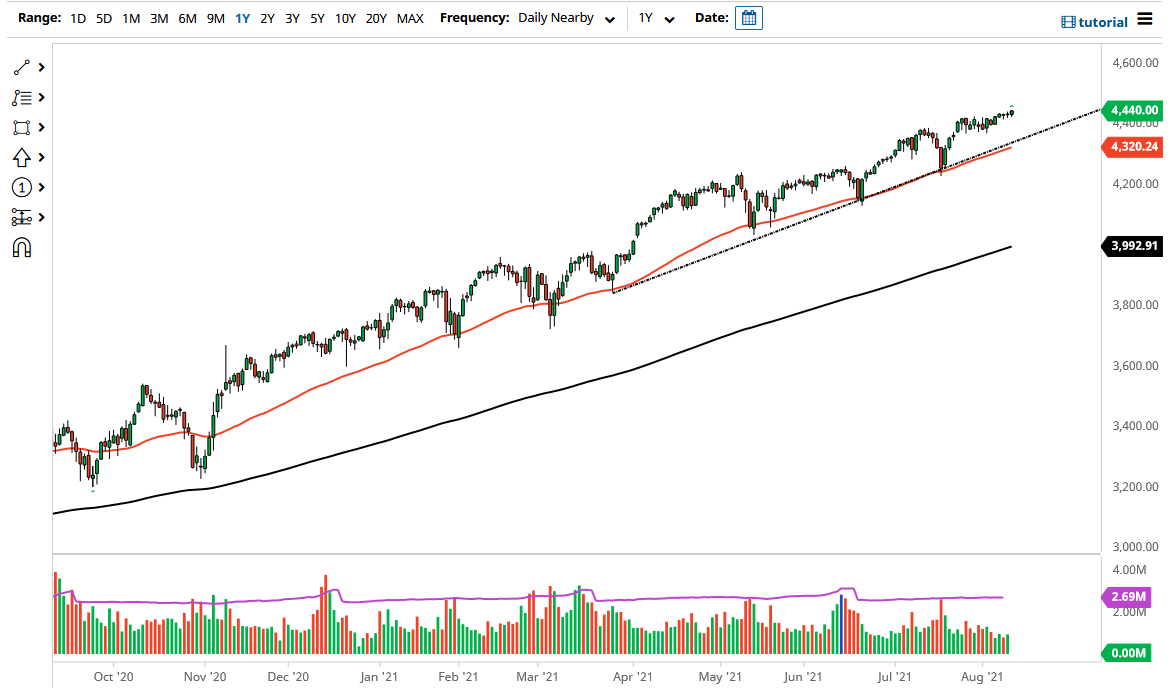

The S&P 500 rallied a bit on Wednesday to reach the 4440 level. Now that we are here, I think it is only a matter of time before we go looking towards the 4500 level above. The 4500 level will offer a certain amount of resistance and headline noise, so at this juncture I think short-term pullbacks will eventually get bought into.

Underneath, the 4400 level should offer a significant amount of support, and even if we break down below that level there are plenty of areas underneath that could offer quite a bit of support. At the very least, the uptrend line comes into the picture and we should pay close attention to that. The 50-day EMA also offers quite a bit of support, which offers a hard floor in the market. If we break down below there it is a very negative sign, and perhaps we would go looking towards the 4200 level. The 4200 level should offer a significant amount of support, followed by the 4000 level underneath. The 4000 level underneath should be massively important, not only from the standpoint of technical analysis and the big figure aspect, but also the fact that the 200-day EMA is racing towards that level.

To the upside, the 4500 level will be a bit of a barrier, but I think it is only going to be thought of as “just another number.” Breaking above that level then opens up the possibility of a move to the 4600 level, which makes sense considering that this pair tends to move in 200-point increments. The marketplace is something that tends to be very volatile and choppy, but the overall attitude is to the upside, not the downside.

Pay attention to the 10-year note, because if the interest rates start to spike again, that could be negative for the S&P 500, as the growth stocks that propel this index tend to be very sensitive to interest rates. However, if the interest rates start to fall, it is likely that the market could turn around and go much higher. Ultimately, I do believe that this market will continue the overall uptrend that we have seen for the better part of the last several years, only with the occasional hiccup as per usual.